Bank stability in the Philippines

Hanjin bites the dust and leaves banks holding the bag. [Photo source: Manila Times]

By JoeAm

I was surprised at the shock wave that rolled through banking and economic news reports on the announced bankruptcy of Hanjin Heavy Industries and Construction Philippines. Hanjin is a Korean shipbuilding company that operates in the Subic shipyard. The bankruptcy left Philippine banks holding the bag for a reported $412 million in loans, and Korean banks another $900 million.

This makes it the single largest loan loss ever absorbed by the Philippine banking system.

You can read the details in this Philstar report: Hanjin Philippines shipbuilding bankruptcy

My interest is the near panic that emerged after the announcement, with banks, the Philippine central bank, and various debt rating agencies making announcements to put financial markets at ease. Fitch Solutions said “The Philippine banking system as a whole boasts robust capital and liquidity buffers, while asset quality remains healthy, with the non-performing loans ratio well-below crisis levels.”

That takes care of the Hanjin loan, but Fitch Solutions went on to say “We believe that the Philippine economy will struggle to reverse its waning growth momentum over the coming quarters owing to tighter monetary conditions, the potential for a re-escalation of global trade tensions, as well as a deteriorating business environment.”

Ominous.

The Philippine Banks reportedly left holding the Hanjin loans were:

- Rizal Commercial Banking Corporation (RCBC) with $140 million

- Land Bank of the Philippines with $80 million

- Metrobank with $72 million

- BDO Unibank with $60 million

- BPI with $60 million

The Bangko Sentral ng Pilipinas (BSP) puts the total of all Hanjin loans at “only 0.24%” of all loans in the country’s banking system. That is of considerable comfort, but I think that kind of industry-wide assessment masks the real risk.

I am inclined to think that if any Philippine bank suffered a damaging loss or series of losses, the emotional public would start yanking money from across the banking system and the dominoes would start to fall, one bank after another. That is a peculiar risk unique to the emotional Philippines. Panic.

So I started thinking about case studies. RCBC took the biggest hit. What does the $140 million mean in the context of the bank’s loan and capital structure?

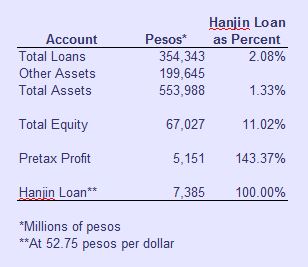

The latest RCBC annual report is for the year 2017, and that will work for our purpose of conducting a broad-brushed “eyeball” analysis. Here is a summary of the loan and capital information:

Well, the Hanjin loan is a big deal, representing a year-and a half of the company’s profit generation and a full 2 percent of total loans. That is way more than the BSP’s happy days 0.24% number.

We can expect RCBC to work diligently to get the Hanjin company sold to someone who can make the loan whole again, or liquidate the assets and recapture a large share of the loan amount. Apparently Hanjin is a fairly new company with new equipment and facilities. The five Philippine banks appear to be working constructively and cooperatively together to recover their loans.

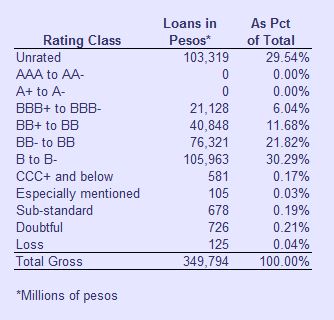

One thing leads to another and our inquiring eyeball finds itself redirected to a section of the annual report that profiles all of RCBC’s loans by credit risk. Here is the profile:

Boy howdy, that does not exactly conjure up confidence. A little less than one third of all loans are unrated, another near-third are in the B* class, and another third is in the two BB* classes.

This is the description of the B* and BB* classes:

- B* More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments.

- BB* Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions

But should we be surprised? The Philippines runs loosely across the board, does it not? Small and mid-range businesses don’t have the same disciplines or backstops as the big boys, there is no consumer credit bureau imposing credit disciplines on consumers, and deals may be based more on personality and handshakes than rigorous financial analysis and standards.

I’m sure the Hanjin loan looked delicious when it was booked.

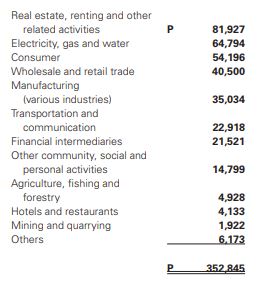

Who does RCBC loan money to, our eyeball wonders? To the right is an excerpt directly from the Annual Report profiling the industries receiving money. Amounts are in millions of pesos.

Who does RCBC loan money to, our eyeball wonders? To the right is an excerpt directly from the Annual Report profiling the industries receiving money. Amounts are in millions of pesos.

Real estate gets most of the money, with utilities next. Consumers make up the third largest category (P19 of the P54 billion comes from credit cards). Manufacturing, a chronic weakness in the Philippine economic structure, has a good-sized presence.

I wonder if Hanjin was in the “Transportation and communication” category. Possibly.

The mix is quite diversified by industry, and that is a good thing. So if lending is loose, at least it is spread around and not wholly vulnerable to a collapse of . . . say . . . real estate.

Conclusions

If I look at this as an individual with bank accounts, it makes me want to limit my exposure (deposits) to individual banks, spreading the deposits around to different banks and staying under the P500,000/account limit that is insured by the Philippine Deposit Insurance Corporation (PDIC).

If I were a legislator, I would want to focus on building greater rigor in those areas backstopping bank loans:

- Continued build-up of precision and discipline in business accounting standards and audits.

- Formation of a consumer credit reporting agency to provide the information base for more active lending to consumers and more disciplined repayment of the loans.

- Implement programs to automate real estate titling, escrow, agenting, and taxation to better monetize consumer-held real estate as loan collateral.

- Issue regular BSP public evaluations of the risk profile of individual large banks. Keep the pressure on the banks to encourage good lending practices.

These steps are not punitive to the economy. They are expansive. They recognize that financial markets must be informed, stable, honest, and disciplined.

Running loose is not a good way to manage an economy, or a banking industry.

Oh gosh, the three top banks are included. RCBC is the top lender? Wow! I’ve worked at Bank of PI close to 21 years until early retirement in 2000. I wonder what their ratings will be next.

I wonder if anyone ever looks at banks and publishes public ratings. Interesting. I’ll explore that. I know the BSP publishes the aggregate financials but I don’t recall seeing a rating of the banks anywhere.

BPI usually does. We could always see them inside the elevators when they are rated by Moody’s and Fitch too.

Are these bank loans have no collateral?

Can banks not foresee the possible bankruptcy of its debtors?

I am still thinking that it is close to impossible from banks to incur losses on loan revenues because loans are insured with collateral which values are much higher than the amount of the loan. Or am i wrong?

The ratings mentioned in the report are an objective attempt to judge the risk of loan loss. Loans can be collateralized or unsecured. The Hanjin loan appears to be secured with good collateral. Banks do incur loan losses because they cannot always predict changes in circumstances. They have “loan loss provisions” which are taken from earnings to provide coverage of expected losses.

See Chemrock’s elaboration on the deal.

Banking operations are subject to all sorts of risks and there are various levels of control mechanism to address risk minimisation. There are Basel Accords, Central Bank requirements, and bank’s internal requirements. I understand Bangko Sangtral has compliance requirements that are more stringent than Basel’s, thus making Philippines banks financially stronger.

This Hanjin loan problem is a matter of credit risk, which is just one of many risks that banks are exposed to. If banks are stringent and comply with the 3 levels of requirements (Basel, Central Bank, internal) then such credit risks can be contained in the event of failures such as Hanjin. That Bangko Santral and the banks involved are confident they can take the Hanjin hit is testament to the risk controls being complied.

There are various aspects of credit control, one of which is exposure to a single borrower. This takes the form of a restriction as to the percentage of loans to a single entity in relation to capital and total loan portfolio. It is obvious this is being observed. This control is designed to prevent a failure of a big corporation to pull a bank down.

Banking regulators monitor banks in their jurisdiction with an eagles’s eyes. There are daily, weekly. monthly, quarterly and annual reporting requirements, plus regular inspections. If the central bank is functioning well, the industry’s risks are minimised. As I mentioned somewhere before, 2 institutions in Philippines are doing well — Bangko Sangtral and COA , and these are untouchables by the President.

With regards to the data on RCBC:

The loan should be under ‘Manufacturing”

The pre-tax profit of 5,151 million pesos for 2017 — we don’t know how much provision of the Hanjin loan as been made or written-off. If a substantial portion has already been made,the impact on future P&L will be less.

With regard to how much they can recoup:

– I believe all these loans are unsecured. Such is the nature of financing for big corporations. There may perhaps be some form of guarantee from parent company, but this has no value as Hanjin Korea is already bankrupt.

– If they are working capital loans, they are likely to be subordinated to other capex loans. RCBC is a refinancing loan, so it is likely low in the pecking order when it comes to distribution to creditors.

– If they are project loans, I’m inclined to think a better possibility of uncompleted projects to be transferred and continued via another entity, thus securing better returns.

Loan provision:

Hanjin Korea’s problems were already well known by 2015. They filed for protection in 2016. So I would assume the banks’ loans have already been substantially provided for.

Land Bank:

Of all the loans, only the one from Land Bank should be open to querry. It is likely this is ultra the bank’s mission of lending to the agricultural sector.

Emotionalism:

Whilst it’s a big financial problem, it’s all part and parcel of economic activity. It will be processed under whatever proper legal channels. Already we see 2 typical Filipino reaction:-

– Labour group BMP demanded that Hanjin prioritize workers’ compensation and separation pay before paying off creditors and investors.

You can’t demand anything. There are liquidation laws to follow in such a situation. Everybody’s interest will be taken into account in accordance with the process of liquidation. There are pecking orders when it comes to pay-offs.

– Leyte Rep. Henry Ong, chairman of the House Committee on Banks and Financial Intermediaries said the Securities and Exchange Commission, the Bangko Sentral ng Pilipinas and the Department of Labor and Employment must jointly intervene “to make sure the interests of all stakeholders are protected.”

Wow for a law man to suggest ‘intervention’ is scarry. There must never be intervention in such a situation. Just make sure liquidation laws are complied.

Thanks for the elaborations. What do you think of the loan portfolio ratings for RCBC. They seem to be on the weak side but I’ve not looked at the composite for all banks, or other individual banks. Are there “A”, “AA”, and “AAA” quality loans in the Philippines, do you know?

In reading about the case, the bankers seem to be cooperating on recovery rather than going after Hanjin “each to his own”, and I got the sense that they think they can be made whole, or largely whole, because the equipment and facilities of Hanjin in the Philippines are in great shape.

I have no idea what the ratings refer to. For sure there is no credit rating agency in Philippines. So obviously these are either internal ratings or central bank classifications where certain criteria are applied to grade the loans. Meaning – subjective basis.

There are $900 million loan from Korean banks. and $400 million from Phil banks. We don’t know which loans have priority. I think the Korean banks would most likely be the earlier lenders, in which case it would be capex in nature and thus probably secured by a debenture (on the equipment n facilities). They will be the guys with higher priority for repayment. Of course, the best way out is for the corporation to acquired by a third party. I read there are Chinese interest, so probably Dennis Uy will get another bite of the Philippines Pie. There are also calls for the govt to take over the corpn. Easier said then none — who has the experience? Is it opportunity for other yards to take over? If Hanjin is still running full on their orders book, it may sound possible. However, the shipping industry is currently in excess capacity, and expected to be so all the way to 2030.

Thanks. Re your last line, I believe that is why Hanjin bit the dust.

*******

1. Thank you, Joe Am and Chemrock, for answering the questions I had in mind. My questions relate to Hanjin and not to the banks.

2. The first question I had was: “Is the shipbuilding industry profitable at this point?”

2.1. It seems the answer is: “Not so much.”

3. My second question was: “Why did Hanjin Philippines fold? Was it lack of capital? Lack of competent management? Lack of labor expertise? Lack of orders?”

3.1. The answer seems to be the company was “financially distressed due to its heavy debt” and “revenues falling behind” as stated by Gerardo P. Sicat in the referenced article.

3.2. International “excess capacity” is another answer. It is not “an unexpected glut in shipbuilding demand” as mentioned by Sicat. “Demand” should be “capacity.”

4. But the answers to the second question beg the question: “Was there not a feasibility study made prior to the company’s establishment in 2006?”

4.1. I’m sure there was. And it seems the prospects were good. From Wikipedia:

o The first shipbuilding contract was for 4 container ships

o As of April 2011, the shipyard had delivered 20 ships

o In 2013, the shipyard made its first oil tanker

o In 2016, it delivered its first gas carrier

o It has build container ships, bulk carriers, and VLCC for the Malampaya offshore project

o Wiki names 39 ships and notes that there are more

4.2. Wiki notes that there were alleged labor violations and over 30 workplace deaths.

5. My fourth question was: “As a maritime nation, cannot the government take over – nationalize? — the shipyard for domestic usage? Such as interisland ships and ferries, coast guard cutters, naval ships, exploratory vessels for the WPS and Benham Rise?”

5.2. I would guess not?

6. My last question would be: “Will a Chinese company be permitted to take over the shipyard?”

6.2. I hope the answer is no.

*****

Thanks for your data on the shipbuilding of Hanjin, and your point 5 which to me seems like a “no brainer” for a country that wants to build its naval presence and is now buying big bulky ships from the US. If ever there were an opportunity to establish a military/industrial foundation, this is it. But I think left hand does not talk to right around here unless it is suitably greased.

(3) I’m not familiar with Hanjin’s problems. I think it started with the Korean shipping company. Over capacity and decrease in global trade saw rates tumble. Many shipping lines were affected. Hanjin Shipping fall and forced the parent Hanjin Heavy Industries to collapse. Hanjin Phils fall as the parent had fallen and orders ran out due to overcapacity.

(4) In 2006 shipbuilding was still a good market and cheap debt was driving everything up. Note that it’s not a case of Hanjin Philippines started in 2006 out of nowhere. Hanjin Phils was just a Hanjin expansion out of their Korean yard — matter of searching for lower rate yard plus space constraints in Korea.

The good years ended with the 2008 financial crisis.

(5) Anybody can take over provided the price is OK. Question is if a seasoned player like Hanjin can’t make it work, can you? Sure, you have retained skilled labour and executives, but the new management team – what calibre is there. It takes a decade to to learn the the trade.

According yo the very moody Moody’s, it remains stable for now.

Moody’s: Outlook for Global Shipping Sector Remains Stable

The outlook for the global shipping sector for the next 12 months remains stable on the back of expected supply-demand improvements in the dry bulk and container shipping segments and overall sector earnings growth of 4%-5%, according to ratings agency Moody’s.

However, the outlook for the tanker segment is negative as supply remains high and charter rates low.

“Demand will slightly outstrip supply in the dry bulk segment, while supply and demand are likely to be pretty evenly matched in the container shipping segment. This combined with our expectation of 4%-5% organic earnings growth in the next 12 months underpin our stable outlook on the global shipping sector, despite continued oversupply in the tanker segment,” Maria Maslovsky, Vice President – Senior Analyst at Moody’s, said.

“Recent US tariff announcements targeting steel and aluminium imports from certain countries and potential retaliatory action pose downside risks to the global shipping sector,” Maslovsky added.

In the dry bulk segment, over the last 12-months to April 2018, the size of the global dry-bulk fleet grew by just 1%, a positive for the segment. Moody’s expects that demand will outstrip supply by about 1% in 2018. Charter rates have improved, but the rating agency expects them to remain volatile.

In the container shipping segment, broad macroeconomic growth coupled with trade growth will support demand. However, high supply growth, especially in the first half of 2018, “will likely prevent material further increases in freight rates.”

In the tanker segment, significant new deliveries will continue in 2018 after a surge in supply in 2017, with crude tankers representing the lion’s share. Moody’s said that the industry will take time to absorb these deliveries so charter rates “are likely to stay low over the coming 12 months.”

Btw, I tried to search for credit ratings of banks in Moody’s, but one needs to log-in, so never mind.

Hanjin crisis threatens banks’ credit ratings – Moody’s

Published 5:15 PM, January 15, 2019

Updated 7:25 PM, January 15, 2019

MANILA, Philippines (UPDATED) – The loan exposure of 5 of the country’s biggest banks to South Korean shipbuilder Hanjin Heavy Industries and Construction Philippines may drag down their credit ratings and drive credit costs higher, the latest report of debt watcher Moody’s Corporation said.

Moody’s said the $412-million loan exposure is a credit negative for the Bank of the Philippine Islands (BPI), Land Bank of the Philippines (Landbank), Metrobank, Rizal Commercial Banking Corporation (RCBC), and BDO Unibank, because they will need to incur additional credit charges related to Hanjin, and in turn reduce their profit.

Below are the credit ratings of the 5 banks.

BDO – Baa2/Baa2 stable, baa21

BPI – Baa2/Baa2 stable, baa2

Landbank – Baa2 stable, ba1

Metrobank – Baa2 stable, baa

RCBC – Baa2/Baa2 stable, baa3

The ratings give investors an idea of the credit worthiness of the banks and measures expected losses in the event of a default.

A higher rating also means banks can raise funding from foreign investors at a cheaper cost.

The Baa2 rating, which all 5 banks have, is one notch above the minimum investment grade.

Of the 5 banks, Moody’s said that RCBC has the largest exposure to Hanjin at around $140 million and will be the hardest hit.

RCBC already said it has provisions in place for the default.

The other banks’ exposures are smaller, at around $60 million for both BDO and BPI, around $80 million for Landbank, and about $72 million for Metrobank.

RCBC already said it has provisions in place for the default. Moreover, the total exposure is only 1% of its assets worth P614 billion and less than 2% of the P387 billion in total loans.

Metrobank said its exposure is low relative to its total assets of P2.1 trillion and will not have significant impact on operations.

BPI said that the exposure is manageable.

BDO also does not expect the exposure to have a material effect on its business, operations, or financial condition. The bank said that the Hanjin exposure represents only 0.15% of its total loan portfolio.

Despite the risks, Moody’s said the banks have more than enough capital buffers.

The Bangko Sentral ng Pilipinas earlier said that the biggest loan default in Philippine history will have minimal impact on the public. – Rappler.com

Thank you for this. It tends to confirm what has been discussed here. A hit, but manageable based on what is known today.

Welcome.

That is about cargo handling. Moody seems optimistic. Other sources not so. The reality is rates are down and that hurting the sector.

Hanjin Phils is about ship manufacturing. This sector is way over capacity and new orders drying up.

Thanks again, but with regards to global shipping Fitch disagrees.

https://lloydslist.maritimeintelligence.informa.com/LL1120369/Global-shipping-outlook-for-2018-remains-negative-says-Fitch?mod=article_inline

It is due to poor capacity management.

As for shipbuilding, those interested can download from this site.

https://maritimeintelligence.informa.com/resources/product-content/2017/02/08/15/32/shipbuilding-outlook-report-sample

Karl, shipping operators acquire their own vessels. Building decision is made on a few factors. I don’t pretend that I know much but some stuff I’m aware of. Like the time lag.to commission new vessels — which means by the time vessels are delivered, the economy may have changed. Cost of debt is also one factor. With cheap money, some new vessel orders are placed earlier. This is one of the reasons that let to the glut — cheap money in the past decade. Sometimes the price of steel is a factor. With good prices, owners decommission old vessels to obtain more cash on the scrap values.

.

Especially in shipping there is the peculiar thing that a relatively small change in volume can result in a huge fluctuation of profitability. The market is very volatile. Mainly because there is no stabilizing factor, you need shipping tomorrow, you order it today, often regardless of the prices. There is no option, no alternative. Little forward planning is possible.

Hence, shipyards are exposed to the same volatility, even if ordering, constructing and commissioning a ship takes a much longer time, in bad times, there is no money, so no orders. Few owners can afford to order in lean times and benefit from the lower prices.

Hence my suggestion to develop into a specialized product where the fluctuations are much less because the lead time is so much greater and in LNG especially, there are 10-year-plus contracts so stability guaranteed and then it is a matter of competing on quality and price, regardless if there is a glut..

Muchas gracias amigos!

Yeah chempo, protect bank interests first over and above those of dirty smelly welders and cheap laborers.

Bankers wear expensive suits, laborers wear dirty overalls.

It’s clear who gets first on the pecking order.

You are on moderation already, so I suggest you take care with how you approach discussions. Bankers wear suits because they meet with clients who wear suits. Laborers wear overalls because they would get suits dirty. Chemrock is adding his insights to a discussion about Philippine banks and you are making an off topic remark about social pecking order, as you see it.

Here is the deal. You have a lot to add to a conversation, but if you persist in going off on tangents and then personalizing the off-tangent remarks, I will put you on block instead of moderation. I don’t want to deal with it.

Pardon me for being exasperated, but it is incredible to me how dense intelligent people can be here about the editor’s guidance. I don’t know what your need is to make trouble on my blog. It’s the same with LCX, I-7 Sharp, and others who seem to have a childish need to man-up their arguments and challenge my guidance. I don’t get it.

I would add that if you want to write a blog about bankers as scurrilous dogs in the economic system, do so and we can discuss it as an issue.

chempo took a swipe at labor group BMP for demanding worker interests protection. He is clearly annoyed that laborers should be doing that. He insist on following the pecking order of who gets what first. Obviously in his worldview, bankers get top priority.

I have said it many times here that bankers, investment bankers in particular, are parasitic creatures of the capitalist system. They don’t do anything productive in the real economy. They make money off money, making other people do the heavy lifting. Investment bankers are not called “the great vampire squid wrapped around the face of humanity” for nothing.

Now your site claims to be a forum for understanding and learning. By increasingly becoming onion skinned and a biased apologist for investment banker class, you are stifling some of your readers’ ability to see through the social rottenness caused by these social parasites.

Your views are extreme and it is hard to respond to them. You personalize arguments rather than take on banking as an economic function we can all discuss in open forum. I have offered you the platform for an issues based discussion. You persist on challenging my editorial prerogatives on my own blog site, and that has no promising end for you. I accept the outcome of my decisions, good and bad, and to this point, they have been reasonably good. I suggest you stay out of my arena and simply write to issues.

My views are extreme? Hahahaha, pardon the sarcasm but my views are not any more extreme than your neo-liberal investment banking apologetics.

Here’s the thing Joe. You and your investment banking buddy chempo are both foreigners in a country where I was born and where much of my relatives and family members are still situated.

It is my view that the current iteration of capitalism in the country based on neo-liberal principles and enabled by parasitic bankers is directly responsible for much of the social ills we currently face including, but not limited to, the rise of a populist autocrat from Davao.

So your telling me to fuck off and just leave you and your neo-liberal propaganda site alone is something I am not going to just take sitting down too. I owe it to my family and relatives, if not the Filipino people in general, to challenge the destructive economic forces and ideas that currently blankets the land.

You do not monopolize what you think is good for the country.

Well, okay, there are truths there we can work with. Chempo and I are foreigners, true. Chempo has worked here and lived here and has a financial background that has been very helpful to Filipino readers in understanding MRT, banking, the economy, and other technical issues. I live in the Philippines and my family is Filipino. You live in the United States but are interested in the well-being of your family members here. I fail to see where any one of the three of us holds privileged rights over any other. We all have legitimacy, brains, experience, and the right to converse civilly on this blog.

You offer the opinion that capitalism in the Philippines is failed because it is based on neo-liberal principles and parasitic bankers are the foundation of the social ills we currently face, including the rise of Duterte. This tends to go against the grain of what contributors here have argued, as they point to colonialism and tribal/dynastic social forces leading to the absence of democratic understandings. But it is a legitimate topic. It is too complex, I think, for this discussion thread, and the best way to deal with it is to dedicate space to it. I’ve offered you the platform to put it on the table and see if your contention is well received.

I have not told you to “fuck off”. I have repeatedly asked you not to personalize your commentary and explained the rules for the blog, and my aspirations here. You evidently fail to grasp the concept of an editor’s role and responsibility to the product he produces. You want to rant and personalize here as if we should welcome any wild-eyed troll with a bone to pick. No. No thanks. This is, bottom line, a private blog, and most people understand what the editor is trying to accomplish. I truly wish you could wrap your mind around it.

I’m glad you are passionate about the Philippines. Most who contribute here feel the same way.

It is healthy to challenge destructive economic forces and ideas.

I do not monopolize anything, that is true. I do provide the platform for you to present your arguments in a civil, non-personalized manner.

If someone dies, there are laws to ensure the proper distribution of the estate of the deceased. A favourite mistress might get a big chunk of the properties if the deceased so willed, and sorry for the wife whose father may have provided her husband with a big loan to get his business started. If there is no will, his estate gets distributed under whatever laws of intestacy there is in the country. Yes, there is a pecking order.

If a corporation dies, ie goes into liquidation, there are laws on how distributions are made. Under the laws, there are pecking orders for distribution. Laws are not made up by bankers but the govt. No matter how secured loans are, the govt (unpaid taxes, etc) is always on top of the pecking order. Next comes the liquidators costs. Then the secured creditors get paid off against securities pledged, and if securities realised are not enough to pay off the loans, the balance debt is considered as unsecured debt. All other assets will be realised and the funds thrown into a pool which will be used to pay off unsecured creditors, and finally the investors. I’m not sure about the position of unpaid salaries in Philippines. In most countries, unpaid salaries are not considered debts, thus the liquidators will pay them off first before arriving at the net assets available for distribution.

There are no interest to protect. There is only an orderly distribution order or pecking order to follow. Like it or not, that is the way an organised country works.

The BMP was acting its mandate in behalf of the workers. You do not take a swipe at them for doing so. Your comment was unnecessary and will only reinforce the perception that capital overlords get more social protection than they deserve.

It is exactly this unequal protection before man made laws that enables and perpetuates social injustice and blatant inequality.

And it is this same injustice and inequality that elevates into power populist autocratic regimes not only here but around the world.

So I am feeling in an edgarian mood this evening, and will try to break your comment down into a variety of subordinate arguments.

1.0 Chemrock is defending capital overlords at the expense of the workers

2.0 There is a perception that capital overlords get more social protection than they deserve

2.1 The person or people holding this perception are not identified

3.0 Man-made laws enable and perpetuate social injustice and blatant inequality

3.1 The forms of injustice and inequality are not stated.

3.2 There are a host of factors going into the difference between bankers and laborers upon which injustice and inequality could be assessed: education and the cost thereof, social and economic value of outputs, disparate salary levels, advancement opportunities, social biases that may hold suited employees as “better” than cover-all covered employees, and others.

4.0 It is the injustice and inequality that elevates populists into power in the Philippines and elsewhere

4.1 This seems to be a hypothesis or personal opinion rather than fact as no references are cited

4.2 The matter of how autocratic regimes come to power is worth studying; there seem to be similarities in the US and Philippines

4.3 It is a matter of conjecture if the oligarchs or corporate lobbyists determine whether or not an autocrat gets elected; Trump seems rather to have mastered the gun-toting NRA and rust belt laborers more than suits, but he is himself a “suit” and the “suits” have liked his tax and America First policies

5.0 We probably need some reference material to study to begin to sort these broad contentions out to know the difference between fact and hypothesis

(1.0) Fallacy – it was’nt me. I was not out to protect anyone.

Thanks. I didn’t see it, either.

Investment bankers took the risk and lost. They signed the loan agreement with wide open eyes and had most probably (as they should) taken due diligence and analysis of the risks involved. There were already gluts in the shipbuilding industry as far back as 2008 because of the global trade and financial meltdown. When did they made the loan? Were they coerced by some politicians to do it? How much loss can they absorb? Were they sufficiently capitalized with dollar reserves? Why would Philippine banks give dollar loans to a foreign company? Landbank is in the fray. I thought they’re suppose to be giving out loans to local farmers.

Absorb the loss, take the haircut – that’s what laissez-faire capitalism demands for investments turning sour.

The laborers on the other hand, signed the employment agreement with the understanding that they will do a certain amount of work for a certain pay.

Work done. Pay them.

Chempo taking swipe at BMP for having the audacity to ensure that workers get paid for work already rendered and insisting that they instead follow liquidation pecking order rules is a concrete example of perpetuating an unfair and highly stratified system where the top capital overlords get preferential treatment. Do you still need a reference material for that?

xxxxxxxxxxxxx

“It is the injustice and inequality that elevates populists into power in the Philippines and elsewhere. This seems to be a hypothesis or personal opinion rather than fact as no references are cited.”

Hookay, so why do you think Mar Roxas lost? Why did the 16 million aggregate of mostly economically marginalized folks like taxi drivers, OFW’s and their families, farmers, factory workers, etc voted for the self-confessed killer and maid molester?

Chemrock has explained what laws state as the pecking order. The ‘taking a swipe’ remark is ad hominem.

But Mar Roxas lost. I thought the scurrilous fat cat families had control. Color me confused. The disenfranchised voted for Duterte for a lot of reasons, banking not being one of them. By the way, I note that the communists still characterize the Admin as the “Duterte-US” government as Duterte sidles up to China. Sounds like your argument, too. Color me way way confused on the communist view, too.

Do we hear the Phils banks complain? They are in the business of risk taking. Loan losses are part and parcel of banking business. That is the very reason why we need them. You would rather we don’t have fat investment bankers. Now let’s take your line of reasoning. Fat investment bankers are bad.We don’t want them in Philippines. Now where would business such as Hanjin Phils go to for credit. The govt? OK not directly. A nationalised bank? So you rather have tax payers footing the $400mm loan losses.

“Chempo taking swipe at BMP for having the audacity to ensure that workers get paid for work already rendered and insisting that they instead follow liquidation pecking order rules is a concrete example of perpetuating an unfair and highly stratified system where the top capital overlords get preferential treatment.”

I never mention ‘preferential’ treatment. I said orderly distribution in accordance with Philippines liquidation laws. To be more precise, liquidation will be somewhat like this :

1. Creditors will be grouped into secured and unsecured creditors. Now, I said ‘creditors’ which is distinct from employees.

2. Secured creditors will exercise their rights and dispose of the assets and obtain satisfaction. Excess funds will be transferred to Liquidator. Shortfalls due to creditors will fall under unsecured creditors group.

3. Assume business operations stopped. Liquidators will assess all assets, value them, and sell them off.

4. With all the funds they have, Liquidator will pay off as follows :

– Liquidation expenses (rents, some staff, valuation fees, auction fees etc)

– Debts to govt agencies — income taxes, etc

– Liquidators pay themselves (fees)

– Due to employees

– unsecured creditors

– shareholders.

I don’t see how fat cat bankers and oligarchs or foreigners are favoured parties.

But of course you will cry foul that secured bankers get their money first. In which case you have a tough time to get Congress to review the laws on debt securitisation, mortgages, pledges, caveats, trust, etc.

In a liquidation, my advise to you and all those who beat chest claiming to be standing up for workers, the best way to protect employee interests is to monitor the work of Liquidators. This is where monkey business happens. The process is dragged to earn more time-based fees. Valuations are played to corner sales to preferred buyers. Duplicity of valuation fees. Unecessary professional services — valuers, legal opinions, often duplicated claims. They don’t teach this in economic classes.

“– Labour group BMP demanded that Hanjin prioritize workers’ compensation and separation pay before paying off creditors and investors.

You can’t demand anything. There are liquidation laws to follow in such a situation. Everybody’s interest will be taken into account in accordance with the process of liquidation. There are pecking orders when it comes to pay-offs.”

That was my statement. How that can “reinforce the perception that capital overlords get more social protection than they deserve….” is beyond my understanding.

Labour group looking after interest of labour is noble, but it is not a free ticket to go emo like a well known lawyer who instigated someone to climb over the fence of Camp Crame. But please do try to understand the law first. Liquidation laws are established in the first place to protect the interest of all stakeholders in the first place. This is in contradiction to your comment that “It is exactly this unequal protection before man made laws that enables and perpetuates social injustice and blatant inequality.”

It is emotionalism before understanding the concept of distribution in a liquidation. As I mentioned in response in above threaIt is exactly this unequal protection before man made laws that enables and perpetuates social injustice and blatant inequality.d, i’m not sure of Philippines law relating to liquidation, but I think unpaid salaries is higher in the pecking order before unsecured creditors and investors. Your fat cat unsecured creditors paid second last, your fat cat oligarchs or foreign fat cat businesses the investors are last in the pecking order. Wonder why you are not satisfied with this order.

“You can’t demand anything.”

That phrase is what jumps right out in your comment in reaction to BMP’s position, so cut the bullshit already.

Why mention pecking order? Why mention liquidation rules as the superior guide when you are not sure of Philippine laws relating to liquidation anyway?

I’d give you the benefit of doubt that you may just have used the wrong phrase, but still…

…the slip is showing.

1. “You can’t demand anything.”

TSOH has consistently advocated for discipline in the Philippines. So I’ll repeat that in trying to address the Hanjin debacle, we follow established laws of liquidation in the country. Don’t do the POA Acosta thingy and demand this and that. BMP could do well if they simply say “we are worried for unpaid dues to employees and we will keep a watchful eye over proceedings, instead of demanding anything. That’s a cool. mature and responsible statement.” Don’t instigate climbing over the fence of Camp Crame.

2. This article is about bank stability. The Hanjin debacle may have jolted some folks. My comments were directed at 2 main points —

(a) Chill – It’s an isolated credit risk issue and though $400 million is a big figure, it won’t be a financial disaster as Philippines banking sector is well regulated by Bangko Sangtral and it looks like loans were extended within risk guidelines, as they should be. The exception is Land bank which seemed to have extended the loan that is ultra vires their mandate for lending to agricultural sector.

(b) That there is an orderly process for liquidation. Nobody is Q-jumping for payouts.

3. My description of the liquidation process brings knowledge sharing to the blog which should dispel any notion or fear that asset distribution will in your words “protect bank interests first over and above those of dirty smelly welders and cheap laborers. Bankers wear expensive suits, laborers wear dirty overalls.”

I have no idea why you choose to disrespect workers this way.

4. My ‘pecking order’ is fact, it’s the liquidation laws in operation. It refers to the sequence of payment under the law and where one stands in that order. Nothing sinister nor socially insulting.

5. In the pecking order, the unsecured bankers and investors get to pay last. I don’t see how you can construe that as to preferential treatment of fat cats.

6. I shared my knowledge of liquidation process based on more or less universal processes. Of course there may be slight variation in some countries, particularly where it comes to treatment of employees unpaid salaries. I never tried to dumb down on readers and hence my caveat that I don’t know the details of liquidation laws in Philippines. I believe readers who are not well versed in such matters will obtain some relief from my description of the liquidation process that Hanjin asset distribution won’t be a free for all with the powerful getting everything.

7. Hanjin case is an isolated case of corporate failure. You brought in the ad hominem of financial systemic failures in US and the way the govt handled those messes. Well, here’s the good news for a change. Philippines is not USA and Hanjin debacle is not a systemic banking failure scenario. Let Philippines handle the situation under established liquidation laws.

8. As to your favorite dog to kick, the fat cat bankers, and how often govts allowed them to go scot free, well as I mentioned, this is Philippines and Bangko Sangtral is not the Fed. I refer you to the collapse of Banco Filipino and how honourably Bangko Sangtral handled that case. No tax payers money were spent to rescue Banco Filipino.

Well then you shouldn’t have crammed in the BMP action as well as that of a Leyte representative as they try to protect the interests of laborers because they, the laborers, do not belong in that pecking order in the first place.

Your bringing it up unnecessarily aggravated what is already a perceived conformity bias for the treatment of those parasitic bankers.

And yes, I am calling bankers parasites not fat cats. Fat cats is the term used by neo-liberal Obama to refer to his Wall Street friends. You know, just some cute little pet in your living room doing no harm except for occasional scratching on your favorite couch or pooping on you carpet.

But bankers and global finance are not some cute little pets. They are parasites extracting wealth from the commons.

“The financial sector has succeeded in depicting itself as part of the productive economy, yet for centuries banking was recognized as being parasitic. The essence of parasitism is not only to drain the host’s nourishment, but also to dull the host’s brain so that it does not recognize that the parasite is there.”

That’s Michael Hudson from his book, Killing the Host: How Financial Parasites and Debt Bondage Destroy the Global Economy.

“A parasite’s toolkit includes behavior-modifying enzymes to make the host protect and nurture it. Financial intruders into a host economy use Junk Economics to rationalize rentier parasitism as if it makes a productive contribution, as if the tumor they create is part of the host’s own body, not an overgrowth living off the economy.”

What has evolved, says Hudson, is that banks have “become the economy’s central planners, and their plan is for industry and labor to serve finance, not the other way around.”

https://theecologist.org/2016/feb/12/killing-host-financial-system-destroying-global-economy

Also, Nicholas Shaxson’s The Finance Curse: How Global Finance is Making Us All Poorer gets a review from LSE :

http://blogs.lse.ac.uk/lsereviewofbooks/2019/01/23/book-review-the-finance-curse-how-global-finance-is-making-us-all-poorer-by-nicholas-shaxson/

Here is a link to Wiki’s extensive profile on Hudson. https://en.m.wikipedia.org/wiki/Michael_Hudson_(economist)

I’m sure his seminars were (or maybe still are) challenging. He is a Marxist economist with views other Marxist economists criticize. I don’t grasp the concepts so would not line up behind him, but at least Micha’s ‘parasitic’ claim has credible backing. Still, other economists are staking out opposing platforms so it is by no means a universal claim.

The profile on Nicholas Shaxson is very thin. He has written two books and is a lobbyist on taxes. https://en.m.wikipedia.org/wiki/Nicholas_Shaxson

“Your bringing it up unnecessarily aggravated . . .” I would note is a personalized judgment of Micha alone. It’s a form of judgmental argument I’d encourage readers to avoid making or falling for, a fallacy of one person’s truth being claimed as universal.

Haha, I shall coin the phrase “accidental troll” which is when a person, arguing seriously, uses all kinds of fallacious arguments from ad hominem to straw man as the style to which he or she has become accustomed. As we wend our way through modern debates, we can retain some sanity if we recognize the structural weaknesses in these modern conversations.

@ Micha

“..the laborers, do not belong in that pecking order in the first place.”

I don’t know how else to show you that the employees IN FACT rank higher in the pecking order of asset distribution in a liquidation. It is said people see only what they want to see.

‘Your bringing it up unnecessarily aggravated what is already a perceived conformity bias for the treatment of those parasitic bankers.’

Bias treatment — we are not discussing your ad hominems. We are discussing the context of the Philippines banks in the Hanjin collapse. I showed you with the Banco Filipino example, there would’nt be bias by sticking to Philippines liquidation laws.

“Fat cats or parasites” is your prerogative. You see parasites, I see the Philippines banks making calculated risk and providing $400mm loans to a shipping manufacturer, in the process helping to oil the economic wheels of the country and enabling some investors to provide 20,000 to 30,000 jobs to Filipinos directly, not to forget the providing business to auxillary support services (transport, food, accommodation, etc) and an entire supply chain.

I see banks doing what they are supposed to do — mobilising savings into economic activities, taking risks that savers do not wish to take.

No Philippines banks are going to the govt to ask for bail out. They are working on how best to sort out the problem.

“Nicholas Shaxson” — another ad hominem that I do not wish to get into. No doubt you are attracted by his acerbic parasites description of banks. No doubt Shaxson never mentions that his book was written with the help of advances from some banking facilities.

What you and Shaxson really wants for banks to do in their business mission is to always make a ‘Winner’s Curse’ offer. A winner’s curse is bidding for something way above the intrinsic value of the object.

🙂 “accidental troll”

Reminds me of the carnival game Whac-A-Mole or Cry Uncle: who gives up first loses.

https://en.wikipedia.org/wiki/Whac-A-Mole

🙂

@chempo

When the Subic Hanjin project was in the drawing boards, Hanjin is already a well established player in the shipbuilding industry such that they most likely have ready access to financing from different sources. It’s not as if Hanjin begged for those loans from Philippine banks. It’s more like those Philippine banks need a project like Hanjin to dump their investment money so that it could earn interests and/or profits. The shipbuilding enterprise could proceed with or without those loans from Philippine banks which was just a fraction of the total project cost anyway. It was probably just to accommodate a quid pro quo bargaining on the part of Hanjin for having relocated its operation in the country Thus your assertion that those loans helped or was responsible for the creation of jobs is superficially dubious if not entirely misleading.

On the whole, for-profit private commercial and investment banks are parasitic. It does not create value or wealth in the real economy. On the contrary, it extracts, it siphons wealth from the economy through punishingly high interest payments as well as a slew of complex, if not toxic, devices and schemes for these extractive process (CDS, CDO’s, etc.) Wonder no more why those banks always have grand imposing buildings downtown.

An interesting assessment, and I am sure that Chemrock will have his own response. I find paragraph one at odds with the way banks and businesses actually work, overlaying condemnation of a pretty straightforward, earnest, and honest business. The conclusion that Chemrock is “misleading” readers is therefore both ad hominem and wrong.

Both banks and businesses are out to make as much money as they can for their shareholders. That is capitalism, and it is the competitive arena in which they work that assures they usually are not capable of gaming the markets as perniciously as you claim. The US has anti-trust laws and regulators. The problems of “parasitical” behavior tend to be among the largest banks that run investment banking operations that wheel and deal money as if they were in Vegas. Most American and Philippine banks are just doing what they are chartered to do: collect deposits, make loans, and run a financially sound business. The financial soundness is monitored by several regulators in both nations.

Businesses seek loans to leverage their own profit making opportunities. They get the money they need from major investors if private, from shareholders if public, and from banks and other lending institutions as they can, if it makes sense. The more financially sound the business, the cheaper the loan interest rates on bank loans. Loans are based on negotiated agreements hammered out with bankers, businessmen, and their attorneys. It is straightforward but complex with a lot of variables such as pricing, collateral, and performance obligations that the banks may want to impose on businesses. Whether Hanjin had other alternatives for funding, we don’t know. They obviously borrowed for reasons that looked good at the time. The banks were probably happy to have the loan on their books. More profitable assets, more profit. That’s the way capitalism is designed to work.

Your second paragraph is outside my knowledge bubble and seems to be the realm of economic theory, much like MMT, that is debated endlessly by economic experts who would either agree or disagree with what you say. It is an argumentative fallacy to say that Chemrock or I are being manipulative or scurrilous people because we do not agree with your stance. It would be better if you presented the contested theories and delineate why you think the “parasite” argument makes more sense rather than the others. Your harsh, one-sided accusations against people who are just doing what they do, writing or running banks, is preaching or trolling, it is not teaching. Chemrock and I both write earnestly. Banks and businesses operate honestly. And legally. No need to run around flexing muscles and beating up on those who do not wish to sign onto your own view of things.

Joe,

Indeed, the Hanjin situation is probably just an investment gone wrong because of circumstances and Chemrock is probably right that it followed rules and laws and it therefore is not correct to go lashing out at neither banks nor Hanjin in this situation. That does not mean that they performed very well, there are other players in that business who did better and in that sense, lessons should be learned. But most urgently, a solution should be found to save the company in some form, to safeguard the workers and this business for Philippines.

That said, Joe’s last statement that “Banks and businesses operate honestly. ” should be argumented. And there Micha has a good point. A Dutch journalist, Joris Luyvendijk, spend a year undercover in the London City and the report he wrote is stunning. While there certainly are many people working there who try to do the right thing, the finance industry as a whole is still very sick, few lessons from 2008 have been applied. And it is some laws which prevent a return to 2008, certainly not the morality of the industry as a whole.

Micha has a point.

HOWEVER, lashing out without offering alternatives is very juvenile. Banking is still very much needed and without investment, those 20000 workers are without a job and my savings would be in an old sock and I could not retire.

Micha,

Instead of ranting about banks, maybe it would be more productive to follow economy-101 first and come with solutions on how to improve the performance of banks, the financial industry as a whole, but especially the supervision by the government, and then you just come back and implement your learning and hopefully use the expertise offered free of charge by some well-meaning people on this forum who clearly have a load more experience to offer than you or I can provide at this moment. Like it or not, banking is still needed for the ever increasing population to find jobs and develop businesses, some form of investment banking is required. In Holland, I see trend that people choose “green” banking and the whole industry is slowly changing. It appears that green banking can be profitable as well. It was a consumers choice more than government intervention. It would be interesting to get from you a workable roadmap on how to get responsible (green?) banking implemented in Philippines and more laudable to see you do it.

My own experience is with banks that are not the goliaths of the industry. They don’t employ lobbyists and don’t wheel and deal in sophisticated instruments or diversify into near-bank products. The 2008 crisis primarily involved big, diversified banks who made bad choices. Philippine banks are of modest size, in global terms, and function more like community banks than investment banks, although possibly with more handshakes than American banks. Community banks start up when a group of businessmen decide they have enough money to fund and start it in that community, and attract the local consumer loyalties as a community bank. They are profitable, grow, merge and become branch banks with 3 to several hundred branches. As they become regional in scope, they start getting into more sophisticated asset/liability management and taking risk other than deposits/loans. It is patently wrong to disparage this industry based on what a few big players do. I only know of one California bank that ran a fly-by-night operation (Indy Mac), but a lot failed when the real estate industry went south. Government agencies would swoop in, auction them off, and keep most depositors whole.

It is a business that operates in an arena of risk. That is not bad, or wrong. It powers the economy. Makes markets. Gives consumers useful tools (credit cards, ATMs, home loans, interest on deposits). The risk products (loans) help businesses leverage their capital and work it harder. I don’t think profit is a dirty word, myself. It makes companies work hard and smart.

The bank I worked for in California had strength in agribusiness lending, and competed with the other major lenders of the time (Wells Fargo and Bank of America) and local community banks (as many as there were large communities). The banks each employed commercial lenders who were paid for their skill at structuring deals that businesses liked. It was competitive and they each assessed the risk involved (agribusiness has some tough ones, seasonality, storms, markets for products) and proposed rates and terms and amounts of the loans, collateral required, and requirements on the businesses (level of borrowings, capital, receivables collections, etc). None of these banking officials was a crook. Some were more competent than others. Some were able to sell bad deals to their credit managers and it cost the banks money if the loan went bad. None did anything but try to succeed at their job. They had nothing to do with Shearson Lehman’s business model. They were more like the laborers in Micha’s earlier comments.

I suppose there are three separate issues getting mixed up in this conversation. One is the macro-economic view of banks as intermediaries and dealers in financial instruments. This would be the regulatory structure and would be debated by regulators, university professors, economists, and big picture people. The second level is investment banking, which is when a large bank moves from lending and deposit-taking into dealing in financial instruments in large quantity, seeking to make major hits on trades or investments, or deploying Wells Fargo’s predatory lending practices to make more money. The third level is mainstream commercial/consumer banking which is predominantly loans and deposit taking through a lot of branches.

Level one is theoretical and legalistic, not applied banking. Parasites might work in this group, but I wouldn’t know.

Level two has had some parasites, if that means risk-gamers and advantage-takers and crooks.

Level three, which employs most bankers, is straightforward business management 101. There are very few parasites in this arena and a lot of laborers.

I think Micha is in level one but disparaging level three for the bad deeds of level two. Chemrock and I are seeing level three (he also understands level two but that is not the real issue with the Hanjin deal). Level three is not crooks and con men and parasites. It is people figuring out deals and loans and pegging risks to the best of their ability. Hanjin is just business as usual, but a big loan. It is not crooked dealing anywhere.

@ Micha re your para 1.

Your proposition:

1. Hanjin relocated to Philippines and as a “quid pro quo” (your words) they took on $400mm loans from Philippines banks.

2.Philippine banks need a project like Hanjin to dump their investment money so that it could earn interests and/or profits.

You are saying Hanjin’s financial planning is based on a principle of ‘utang na loob’. I’m sure that is being taught in many business schools.

There was probably tax breaks for them, a common pull factor offered by host country. The only ‘quid pro quo’ is to be a good corporate citizen, hire locals, use local materials, technology transfer, make lots of money and pay taxes. For a few years, prospects were good — new ship orders came in, and great prospects doing servicing and maintenance of the US fleets that visit Subic. (There is big money in them US fleets — I once personally wrote to the command centre of the Far East fleet to try to get a piece of the action in Singapore yards).

So Hanjin need new fundings and where do businesess take their fundings from? From the cheapest source, period. I don’t know of any business school that teach otherwise. If there was a bank in Timbuktu that can lend them 10 basis points lower than the Filipino banks, Hanjin would have grabbed it.

Your counter would probably be that Hanjin is an international conglomerate so they can easily have access to all international banks. Not so easy. There are lots of consideration. Hanjin Philippines is not Hanjin Korea. It is a Philippines risk. Not all banks will take a Philippines country risk, even during Pnoy’s time. Philippines country risk carries a higher cost than Sokor country risk. For Filipino banks, there is no country risk because the borrower is local. Guess whose loans will be more competitively priced?

Your suggestion that Philippines ‘dump’ their investment money on the Hanjin loans implies that banks are sitting around with mountains of cash and then simply lend the money out whenever lending opportunities arise so that they can earn interest. This reflects a total lack of understanding of banking, despite the fact that Joe explained this briefly in some comments long ago, in response to one of your comments. Let me explain this as briefly as I can.

To banks, cash is a trading asset. At the close of business each day, banks only have optimum balances in their vaults,in reserve accounts with central banks, in operating accounts with correspondent banks. There is no idle cash to ‘dump’ on Hanjin. Banks plan for long term fundings – capital adequacy and bond issues. Short term funding requirements are planned daily and sources are from a huge array of money market lines that banks have with each other all over the world. Everyday, banks are moving money in and out, from/ to depositors, from/to borrowers, from/to interbank market as they go about managing their foreign exchange, commercial, investment, and other operations. Eg Hanjin’s loans — $400mm is not taken in one day, it is drawn in small lots over a period of time. When there is a drawing, banks may borrow interbank to fund the drawing. How the bank borrow depends on how they manage their interest rate book. Eg they may borrow LIBOR 1 month. At the end of the month, they need to repay that interbank loan, so they need to take from somewhere else again. They may take LIBOR overnight, and so on. The picture is the source part and the lending part is never matched one for one. It is constantly rolling over on a daily basis. Joe once explained that cash is thrown into a basket as inventory which is constantly churned daily.

To suggest that Hanjin took on Philippine bank loans not for operational requirements but just to please a host country is a tough sell. We should not make light what are very serious, difficult, and stressful decisions by both the borrowers and lenders.

@Pablo

Philippine banks are small potatoes in the stage of giants of global finance. However they are made of the same business DNA as that of their fellow specie like Chase, Deutsche, Citibank, HSBC, or Goldman which had been compared to a giant vampire squid whose tentacles are wrapped around the face of humanity. In other words, they will prey and suck on anything that smells like money.

What’s the alternative?

There are several proposals on what to do with these blood suckers. One is to break them up or downsize their scope such that they don’t have to be TBTF. Another which is corollary of the first is to reintroduce the Glass-Steagall Act or at least the essence of the act which is to separate investment banking from your ordinary savings and deposit bank.

A third is the introduction of public banks or cooperative unions which are already in fact viably operating in many areas or communities in several countries including our own. A fourth is to nationalize all major banks like what used to be PNB or DBP.

The details can be worked out comprehensively by policy makers themselves but the important thing is that the ideas are there and that it is workable.

What we’re doing here is just to raise awareness or consciousness on the socially toxic or destructive nature of these currently existing financial parasites.

I’m not clear on what “socially toxic or destructive nature” means. Can you provide an example case or set of circumstances that makes it clear as to what damages we are talking about? I am afraid I see banks as risk arbiters providing a very useful capitalistic function. Thanks.

This is missing the point. Philippines desperately needs some kind of manufacturing to employ. It needs to attract companies employing thousands of people. And to set up these businesses, you need money. And Joe, Chemrock and me and thousands of others provide that money through savings and investments through banks. No investments, no business. It is not a mom-and-pop shop, but a place where thousands are working for an honest salary. Be it shipbuilding, electronics, whatever. And incentives are needed to attract these activities. Too many businesses have elected locations elsewhere in Asia and unemployment here is unacceptably high.

So, if you have other means to get a company to start activities in Philippines without investment from banks nor tax breaks, that would be an interesting proposal. But if not, then admit banks are a crucial factor in providing employment, the first question is if the legal framework provides enough safeguards. And yes, the pure nature of business is that they can go belly up if not managed optimum, so the second question is if there is enough oversight and support by the banks and government to make sure these businesses thrive. And that last point might be the crucial question to ask.

Because with enough expertise, it might be possible to find a way out.

“It is a business that operates in an arena of risk. That is not bad, or wrong. It powers the economy. Makes markets. Gives consumers useful tools (credit cards, ATMs, home loans, interest on deposits). The risk products (loans) help businesses leverage their capital and work it harder.”

As an IT programmer peon in the early ’80s, I witnessed the fall of banks, giant & small, because of the nature of risk of exposure banks take on side by side with the expectation of profit for its investors. This was called the Penn Square Bank of Oklahoma debacle. The single giant bank was the largest commercial bank of Chicago at the time, the Continental Bank was brought to its knees because of a huge loan to Penn Square Bank, a store-front size bank in Oklahoma catering to the oil wildcat industry of Oklahoma. Most of the other giants in the Chicago financial community were also affected because of syndicated loans provided to the clientele of Penn Square Bank. Many smaller Oklahoma banks were also adversely affected.

https://stateimpact.npr.org/oklahoma/2012/07/05/penn-square-bank-anniversary-of-a-failure-that-changed-finance-forever/

https://en.wikipedia.org/wiki/Penn_Square_Bank

@sonny. Ah, my, you do bring back the memories. I was involved in a business meeting with one of California’s major banks. We were sitting in their elegant dining room having breakfast and discussing how we might jointly bid on a large savings and loan with our bank taking the southern branches and their bank taking the northern (to avoid anti-trust issues). The subject of real estate lending came up, and I can recall their EVP/Credit officer responding to a question about the real estate environment. “If real estate goes south, we are all in big trouble.”

Real estate went south a few weeks later, we never did the acquisition, and that bank was purchased under duress about a year later. There were no crooks in the room, just people working in a risk industry.

That is too easy to say that there were no crooks, just people working in the risk industry. They get paid (some extremely well), so they should know what they are doing and if not…..

If I design a bridge and it collapses and kills people, then I end up in jail when I made mistakes. I know, I have been there and strangely enough I jade to PROVE that I did all the right things before I got a small paper from the DA that the my prosecuting had been suspended. A real nerve racking time where I just hoped that every dot and comma were in the right place.

The bankers, however, all got out free. Even if it was clear that proper due-diligence was never done in case of big loans.

And that is where Micha probably is right, but the solution he provides is not realistic and the question is if the shipyard case was handled properly and it is definitely not correct to assume that fat cats caused a loss of 400 million without doing proper homework on a risk-benefit analysis.

@ Pablo It is a risk business. To look at failures of risk assessment as criminal or parasitic seems rather strange to me. Trust me, bankers work hard to do correct assessments, and have loan reserves to cover a statistically calculated expectation of losses. Some people in banking get paid well. CEO’s get enormous amounts, as agreed to by the Boards who represent shareholder interests. Bridge-building (at least to my thinking) is not a risk arbitration business. It is an engineering enterprise with known forces and strength of materials. Mistakes are not accepted as the norm. In banking, they are (loan reserves, heavy regulation, etc.). Bankers get out free because it is not illegal to miss the risk calculation. As far as it being clear that “due-diligence was never done” we’d have to discuss the particulars of the cases you are referring to. Yes, there have been crooks. No, that is not industry standard.

@Pablo A loan failing of itself is not evidence of due diligence not being done properly. Banks examine failed loans and processes and use the findings to evaluate personnel and upgrade risk assessment standards/processes.

@Pablo, as for salaries, banking is actually a competitive business and banks bid for top talent, which drives up salaries for the investment bankers and top commercial lenders who make the biggest risk assessments. There is nothing pernicious about the salary levels. Tellers are a dime a dozen and so they get paid very little. Branch managers and consumer lending officers get paid a basic salary. Commercial loan specialists get paid very well. Department heads get paid very well. Top executives get paid very, very well. Incentive programs are common across all officer levels. They are tied to the bank’s overall performance and the specific individual’s level of responsibility and results. Larger banks have strong human resources management departments to handle these matters.

@chempo

Hahaha. You are regurgitating once more the clerk level banking operation bullshit when it comes to bank lending even on a scale such as this.

Notice that the Hanjin loans are dollar denominated loans per the news link on Joe’s article.

That means all the loan manager of the investment arm of the bank or the CEO himself has to do is to verify how much dollar reserves they have at the central bank and presto, he can decide how much dollars he can lend to Hanjin. It’s the negotiation aspect of the loan agreement like how much interest, length of maturity, collateral allocation, and all the legalese that needs some work to do. A bank representative might have to invite a Hanjin representative to dinner to hash it out. Or vice versa. Depending on which party has more need of the other.

Loans are where banks make their killing (profits). To say that they might have to pass on what appears at that time at least to be a good investment opportunity because they don’t have enough money collected from their day to day operation is complete bullshit.

@Micha Ad hominem fallacy. Chemrock has not responded in kind. Also, profits are not “killings”, they are returns for the risks shareholders or investors are willing to make.

Given that LCX has moved on, I herein appoint you “Chief Troll” here at the Society. The level of emotionalized argument, distortion, ad hominem, and nonsense is truly exceptional. Congratulations on the distinction.

Chemrock and I have worked in banks and you are denying the knowledge we are attempting to share. What are your credentials, if you don’t mind me asking, that give you such greater wisdom as to how banks operate? It seems to me you are an excellent case of the “confidence of the dumb”, or the arrogance attached thereto.

@Pablo

See second alternative.

You can get all your investment money needs from an investment bank, separate and distinct from your ordinary savings and loan bank.

Other than that, you are clearly not updated on the nature of modern bank lending. That would require a separate topic or at least a separate thread to discuss if you’re interested.

@JoeAm

The world as we know it was nearly wiped out by the banking crisis of 2008. The after effects spread through Europe, the Middle East, Asia, and the southern continent. Millions lost their jobs, rendered homeless; significant number committed suicide, millions more suffered from the austerity policy measures adopted by governments such as those in Greece, Spain, Italy, Britain, US, Japan, even here in the Philippines, etc.

To this day, millions more have yet to recover from that great recession. The wealthy have recovered, alright, but a huge chunk of the middle class did not. It is from this toxic environment that populist despots and autocrats emerged.

If that is not enough evidence of toxicity and destructiveness in the social, economic and political realm brought about by these parasitic behemoths then I really can’t help you.

@ Micha. Okay, you are arguing level one in generalities (economy, laws, regulations), and level 2 (investment banking) on the particulars as to flaws in the system (the 2008 crash). What is your proposed alternative to investment banks acting as market-makers and risk arbiters for large corporations and high-volume markets (e.g., mortgage loan securitization)?

I would add that if the Philippines had developed the same level of financial products, competitive rigor, and financial markets as the United States, GDP would be growing at 10% a year or more and poverty would be long gone.

@ Micha re your para (2) in the 3.46 am comment:

RE INVESTMENT BANKING

I asked in another thread if you could explain what investment banking activities Philippines bank do that can drag the country into financial collapse. I assume this para 2 is your response. Thank you for the explanation.

You provided generalities which side-stepped the question, generalities that are impressive sounding but explains nothing. It’s called pseudo-profundity.

For clarity, I’ll expend some time on this topic in the interest of readers who may otherwise recoil at the thought that Philippines banks are leading the country to financial collapse as they pursue profits at the expense of national interest.

The idea of parasitic investment bankers remind me a childhood event. Back in the very old days, ice cream (the simple stick type) was sold by a guy carrying an big tub on one hand, and a bell on the other. He went along the street clanging his bell. I was about 6 and elder brother about 11. My brother got himself a tub from someone, and he went clanging his bell into our village. He came upon a little kid who wanted the ice cream. Kid said ‘gimme gimme’. Dad said no. Kid wailed and pulled tantrums. Dad screwed my brother and kicked him out the door.

Moral of the story — it’s easy to blame the service provider.

Investment banking is basically the provision of financial consultation to customers. Lending used to be a simple provision of funds to a customer. This direct lending is now called boring commercial loans. The world got complicated, and loans got complicated. Complexities grew out of basically the needs of both lenders and borrowers to mitigate their risks, and to navigate around legislative and transactional difficulties. Out of this evolved investment products/services and financial innovations that the business world and the investing public need and want.

Typical investment products that serve todays needs include things like corporate finance, mergers & acquisitions, investment research, capital raising solutions, special industry financing expertise (green energy as per Pablo?), syndicated loans – managing, running books, underwriting, market maker for various securities, bespoke financial solutions, etc, etc.

Out of investment banking activities came all sorts of financial instruments and derivatives. These could be plain vanillas – like options, swaps, futures, bonds, etc and other exotic securities.

The fact that investment banking products and instruments are still around is because they are needed. It has helped businesses to minimise risks and make their operation viable. It has helped to stabilise cost in some cases making it easier for people to do business. It has helped people to make business decisions which they would’nt have without the financial tools and understanding,

Take a simple illustration. A wants to borrow $1billion for a project. They want a fixed term 5 year loan in Peso equivalent because they don’t want the $ risk and also they have a matching 5 year fixed peso term asset. Investment bank B arrange a syndicated loan, underwriting 50%, means if they can’t sell down the loan (meaning they can’t got get enough banks to join in) B will take up $500 of the loan themseves. It’s near impossible for B to source $1billion equivalent of pesos, so B structured the loan in $ with $/peso swaps. B goes out to find one part of banks interest in lending out $, and another party who can provide the peso swaps.

Some derivatives can get very complicated, and where investors get burnt. Don’t blame the complexities, blame non-observation of investment 101 — invest in what you know. (How many people actually understand the bitcoin they invest in?).