Banking in the Philippines, Part I: The fundamentals

This will be a series of blogs. By educating myself in this public forum you may track along with me and decide if it all makes sense. If it does not, I presume you will offer up a little guidance.

We’ll start by seeing what information is available at the Bangko Sentral ng Pilipinas web site, then proceed on to examine specific components of the banking system including individual universal banks and micro-finance programs. The project will take several months to complete.

The types of banks

BSP organizes its regulatory functions to monitor and regulate four different types of banking institutions:

Universal and commercial banks. This is the core of the banking system. Full-service banks accept deposits, make loans and provide fee-based services. Universal banks also provide investment banking functions.

Thrift banking system. Savings and mortgage banks, private development banks, stock savings and loan associations and microfinance thrift banks. Specialized institutions that help small and medium enterprises and individuals with working capital and business products.

Rural and cooperative banks. Small local institutions that mainly assist farmers during the farming cycle of planting to getting goods to market. Rural banks and cooperative banks differ by ownership. Rural banks are privately owned and managed; cooperative banks are organized and owned by cooperatives.

Non-banks with quasi-banking systems. Institutions that borrow funds from 20 or more lenders for the purposes of relending or purchasing receivables and other obligations.

Regulation of non-banking functions such as trust companies and pawn shops also falls within the jurisdiction of the BSP. We will attend to those activities after we are done with banks and quasi-banks.

Economic need and economic risk

The banking regulatory system essentially evolved to satisfy the specialized needs of different market groups: private individuals wanting to lend money, cooperatives in the farming areas needing loans, and major banks wheeling and dealing in international markets. Market needs drove the regulations, not the other way around. Regulations are a rats nest of particulars that we will shy away from except as need warrants.

Economic risk is driven by the question of “what happens if a group of institutions goes bankrupt”, which leads to the further question of “where are the risks that might drive an important set of institutions bankrupt”? We will eventually conduct our own stress test of the most important institutions.

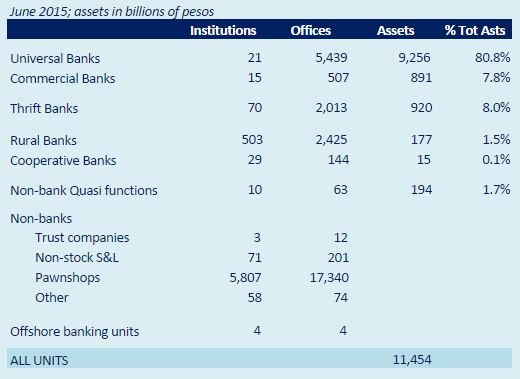

For now, let’s start with a profile of the number of institutions, offices and assets held by banks and quasi-banks. It is important to understand that banks are inverse institutions. A loan for a bank is an asset on the balance sheet and a deposit is a liability (customers can demand the return of their money at any time). So when we look at assets, the bulk of it is loans outstanding:

Well, we can see that the concentration of risk and economic power rests in three types of institutions. About 97% of all assets are held by universal banks (80.8%), commercial banks (7.8%) and thrift banks (8.0%).

Given that such a huge concentration of assets (and risk) is assigned to only 21 institutions – the universal banks – we ought to be able to spot individual banks that pose the greatest risk . . . or capacity for service if they are well run. Let’s place that on our “ToDo List”.

Other interesting notes that pop up from this profile are:

- If there are only 70 thrifts, which include micro-finance institutions, there can’t be very many official micro-finance lenders. There is likely some (a great deal?) of out-of-regulation lending going on by private individuals. The unregulated market requires special examination.

- Pawn shops and their brother-in-service, payday loans (borrowing against a future paycheck), are considered ethically challenged by many in the US, as they seem to take advantage of the most vulnerable people (those who are poor and lacking in financial education) with the most outrageous of interest rates. Yet, in the Philippines, these institutions serve the “great unbanked” population. They are an accepted part of the financial set of intermediaries between lenders and borrowers of funds. This also deserves future inquiry.

- We’ll have to identify the four offshore banking units and discover what they do.

- There are a lot of banking institutions. Thrift and rural banks will become increasingly un-economic as labor costs rise, and will merge. There are also likely to be further mergers among universal and commercial banks, especially as ASEAN integration proceeds. We’re likely to see foreign banks acquiring Philippine institutions.

As a first step, let’s examine that 80% set of 21 universal banks, as an aggregate, to see what their financials look like.

The balance sheet basics of universal banks

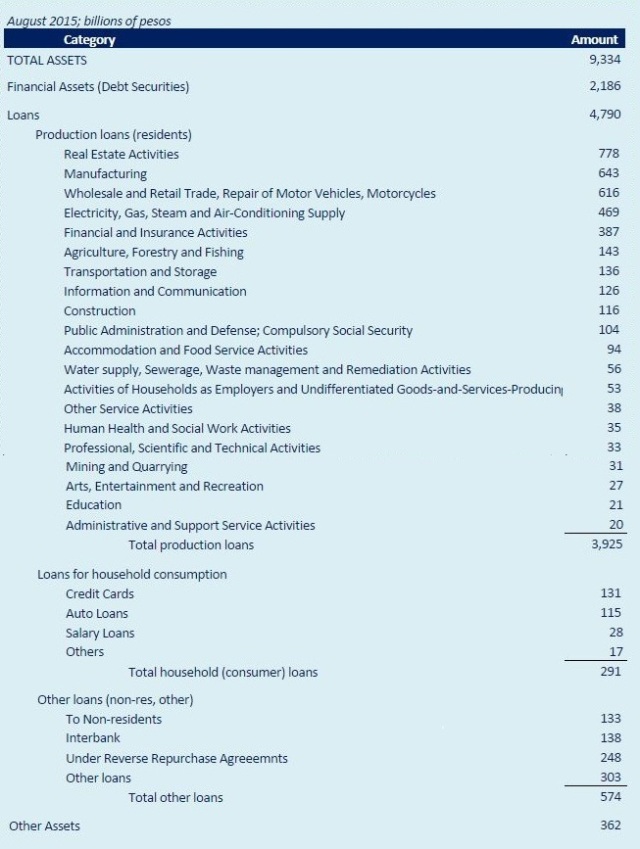

The 21 universal banks have assets of almost 10 trillion pesos, or roughly 500 billion each. Here is the composition of assets:

Debt securities represent over 20% of all earning assets. These are sourced via financial markets and, assuming many are Philippine government issue, then are as safe as the Philippines (low risk), and they earn commensurately lower rates. Another 5.8 trillion are loans requiring an individual assessment of the borrower and carry risks at three levels: the economy, the specific industry, and the individual borrower. These assets earn at higher rates, and we will explore this as we dig deeper. For now, let’s note some take-aways:

- The “production loans”, which in the US would be called commercial and real estate loans, fairly well mirror the main components of the economy, which these banks fund. Real estate, manufacturing, and wholesale/retail trade are the most prominent “industries” supported by bank loans.

- Loans for household consumption are a small part of all lending done, reflecting the nation’s lack of credit infrastructure (credit rating agencies) or well-paying jobs that can support generous borrowing.

- Lending is pretty well diversified, as an aggregate portfolio, and when we examine individual banks, we can look to see if their portfolios hold any undue concentrations, such as real estate lending, that might leave them vulnerable to industry risk. We will also look at loan loss experience.

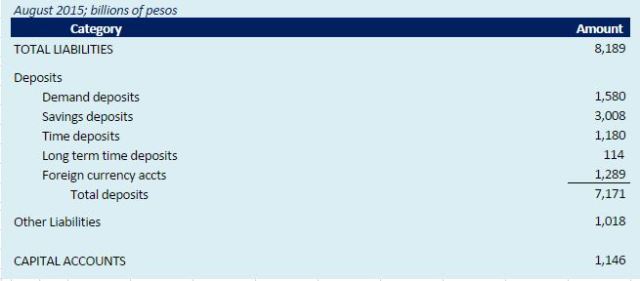

The deposits which fund these lending activities are sourced through domestic branch deposits.

The Philippines is a cash society and banks benefit from holding that cash for customers at interest rates that, for now, give banks nearly a zero-interest cost of funds.

Summary

We’ve learned that 21 universal banks represent the heart of the economy’s money intermediary function. They hold 80% of all financial assets, with the bulk of the assets being loans to businesses. Loans as an aggregate portfolio are well diversified. Funding is by domestic deposits.

Here is a checklist of future topics to be addressed:

- Income performance, performance ratios, and loan risk for universal banks

- Examination of selected universal bank financials

- Understanding “grass roots” banking: microfinance, pawn shops and payday loans

[Note: readers have pointed out that there are errors in the table arithmetic (see discussion thread). I believe these are not material to the lessons drawn and will leave them in the paper as an exercise in discipline, looking for the forest and not obsessing over the trees. If the conclusions or lessons drawn are incorrect, kindly let me and readers know in the discussion thread. If you wish to know the precise numbers, refer to the BSP web site (link provided early in the text). Put another way, I did this exercise for myself, shared it with readers, and have moved on down the road. I don’t care about the arithmetic, but the size and shape of banking in the Philippines.]

Comments

215 Responses to “Banking in the Philippines, Part I: The fundamentals”Trackbacks

Check out what others are saying...-

[…] Review of “Banking in the Philippines, Part I, the fundamentals“ […]

Let me add Central Banking in the Philippines

Click to access pidsdps0210.pdf

http://www.hss.de/southeastasia/en/philippines/our-work-in-the-philippines/micro-finance-and-micro-enterprise-development.html – small item to add in the microfinance area:

In pursuit of HSF’s commitment to help contribute to poverty reduction in the country, HSF embarked on a pioneering program in 2008 to provide support to the microfinance sector in the Philippines. In partnership with the PinoyME Consortium (PinoyME) and the Ninoy and Cory Aquino Foundation (NCAF), and with the support of the Microfinance Council of the Philippines (MCPI), the “Microfinance Capacity Building Program” was jointly initiated. The purpose of the Program is to develop the capacity of microfinance institutions (MFIs) to enhance access of marginal sectors to innovative products, markets and services. The program has 4 components: i) curriculum development and standardization for MFI personnel; ii) organization of a training faculty for microfinance courses; iii) research and development for new microfinance loan products and services; and iv) organization/ networking of training institutions/service providers for micro-enterprise development.

The Program implementers, together with microfinance industry (MFI) partners and the academe, focus their efforts in completing the requirements for the full implementation of the Dual Training System (DTS) Competency-based Curriculum (CBC) for the Microfinance Sector. The Program has two offerings namely, one-year training under the Technical Education and Skills Development Authority (TESDA), and a 4-year ladderized degree program under the Commission on Higher Education (CHED). Both, the short-one-year training and the 4-year ladderized degree program, adopt the Dual Training System (DTS) through a standardized competency-focused learning process. The Program addresses the lack of entry-level loan officers (frontline staff) needed by the MFIs for their expansion. It provides an option for those who are interested to build their career in the microfinance sector, as well as for those currently employed, to continue their studies and earn a degree while working with an MFI. The DTS-CBC for Microfinance will follow the career path of the loan officer to higher positions. The pilot program is being offered by three schools (located in the provinces), which will run the initial 2-year Associate Course (certificate) in Microfinance for loan officers (in-school), and the MFIs based in these areas will provide the on-the-job training (in-plant). Those interested on further studies can proceed to the 3-year Diploma Course in Microfinance up to the 4-year Bachelor of Science in Microfinance, in close cooperation with MFIs.

Research studies, specifically on Agricultural Microfinance, on Business Development Services and on the State of the Art of Microfinance and Microenterprise Development in the Philippines have been completed to assess the current situation in these fields of interest and explore opportunities to expand access, not only to credit, but also to innovative products and services to microfinance clients.

The involvement of the Ninoy and Cory Aquino Foundation shows that Bam Aquino’s initiatives seem to be very much in line with family values. I particularly like the agricultural microfinance aspect, and the Business Development Services aspect of HSFs program.

I appreciate the info on microfinance, Irineo.

Wow – you mentioned before that you worked in a private bank before and it shows. You really are in your element here. This should be interesting months ahead, a welcome respite to heated political discussions, although I will not neglect that, too, as the country’s and our future will depend much in the outcome of the May 2016 election.

As in Micha’s article, I might be rendered mute or silent in this offering. My only experience in this area of finance is when I worked as accounting supervisor for a financing company, engaged in quasi-banking functions. I will reserve my comment when discussion reaches that topic, however little I could remember, since that was my second job many many years ago.

I will read and digest all the info offered.

“21 universal banks represent the heart of the economy’s money intermediary function. They hold 80% of all financial assets, with the bulk of the assets being loans to businesses”

I take heart in the global finance think tanks that say the Philippine banks are solid and stable and has enough shield in the system to counter any “Lehman Brother-kind of problems” that might arise internationally. What I am worried about is chempo’s warning of a real property bubble locally that is about to burst. Thailand, if I’m not mistaken, had this kind of problem which affected the whole region. The US too, which has just started to recover, the ripple effect of which was felt in Europe and elsewhere.

I really want to understand how this whole thing works as this is also linked to the day to day lives of the middle class and the poorest of the poor, for I know that the oligarchs are pretty much covered by any uncertainties much like the millionaire Greeks.

I must confess, I’m totally green and it shows.

We’ll learn together, Mary Grace. Perhaps that “RE Bubble” can be added as we look at specific banks and look at loan quality/risk. RE loans make up 16% of all loans, which is big, but I don’t think as large as US banks have, or had, in 2008. I’ll include comparatives on US banks in some of our comparisons going forward.

Thanks, will forward to this. chempo was into banking before, too so his insights will add to our learning

Singapore and US styles, wow – that would be great

Am no financial expert of any kind, but was alarmed to see that real estate development tops loans, and agriculture coming in only at no. 7. The property situation is not quite as dire as in some China cities with bursting and burst real estate bubbles, but there have been warning signs of possible overbuilding in property development, most obviously in clogged Metro Manila. If the economy continues to do well under the next administration, all these spaces will be filled, and the banks can heave a sigh of relief, but it’s unnerving to see the large proportion of loans going to this sector.

Agriculture–which covers everything from traditional crops to higher-value “new” crops and mariculture, e.g. lapulapu grown offshore–has been in the doldrums. Not for lack of money or opportunity or demand from here and abroad, but because not a whole lot of people in this administration and under past presidencies have been thinking about it. There just hasn’t been an integrative vision at the center of things that ties together infra, logistics systems, intra-regional and export markets. Then there are those perennial land tenure issues…

in the 90s Agriculture credit was still the top.

Click to access pidswp9302.pdf

agricuture and banking in the philippines

A paper on the potential risk of a housing bubble

Click to access pidswp9302.pdf

oopsy, wrong link.

here is the link for housing bubble.

Click to access Ballesteros-Housing.pdf

latest on real estate bubble

http://cnnphilippines.com/business/2015/05/22/sunny-ph-real-estate-2015.html

Yes, the article says there is no bubble. Well, the guy quoted sells RE, so he for sure does not want people to get afraid. I’m reminded of the position RE agents in Las Vegas, NV take, as the water behind Hoover Dam shrinks below the outlet level. “There will always be water in Las Vegas”. Uh huh. The new subdivisions plant cacti in the yards and the toilet water goes to a recycle line.

From someone who says there is a bubble

http://www.manilatimes.net/ph-housing-bubble-forming-expert/220920/

Good common-sense warning both to banks, to make sure borrowers are qualified, and to builders, to not get greedy. The RE expert says a bubble does not yet exist, actually, but there are signs “of frost”.

oh yes, I overlooked the operative word “forming”.

https://en.wikipedia.org/wiki/BayWa – this is a concept that works for small and medium-sized farmers, it comes from the mainly agricultural (and Catholic) state of Bavaria, to farmers who often do not even speak High German properly and are simple people…

Based in Munich, BayWa Aktiengesellschaft is a German company which operates in the agriculture, building materials and energy sectors. It provides trading, strategic and other miscellaneous services in these sectors.

(Agriculture) is subdivided into three units, Agricultural Trade, Agricultural Equipment and Fruit. The trade unit provides the farmers with an assorted supply of various products which are of importance for the agricultural industry right from the sowing of seeds until harvesting the crops. Besides these products, it also gives guidance and counseling to farmers over issues related to agricultural farming and business. In the Equipments business, BayWa provides a range of machinery, from heavy machines to small sized appliances, to a range of customers including farmers, foresters and the general public. Besides, BayWa also takes contracts for planning and building of agricultural facilities. It also provides service for the entire product range.

(Building materials) provides products and services for new constructions, renovation work and entire modernization in both rural and urban areas. It also has two sub units, Building Materials and DIY & Garden Centers. BayWa has its sales centers in Germany. It also operates via franchisees in Germany, Austria and Italy. Future plans include entering the market in Bosnia and Herzegovina and Croatia. BayWa is among the largest full line suppliers in this field. This segment forms about 25% of BayWa’s total revenue. Of this, 75% comes from the building materials and only 25% from the garden and DIY unit. There are about 271 locations in Germany and Austria. Around 600 franchised locations are there. Germany is the biggest domestic market. The revenue of this segment was €1.6 billion.

(Energy) is particularly involved with the sale of heating oil. Besides, other fuels and lubricating oils are also traded. This is the third largest portion of BayWa’s revenue and generates about 25% of the total revenue. The main articles of concern are heating oil, diesel and Otto fuels [clarification needed], lubricants and solid fuel generally as wood pellets. Main sales areas are Bavaria, Baden-Württemberg, the new German federal states and Austria. There are sales offices at several locations. There are about 275 fuel stations owned and operated by BayWa in Germany under the name of BayWa and AVIA. Sales in Austria are done through a group holding GENOL, which supplies fuel to around 500 stations. The major business activities are supplying of local authorities, commerce and mineral oil trade.

I’ll do a special blog about loan quality and risk, but it almost seems like I need to add a look at RE developers who are putting up all the high rises. My thinking is that many have very deep pockets and can handle a significant downturn. It is not the empty units that bother me. If there were a collapse of the BPO industry, then that would be a different story. Individual borrowers would bail and it would be bloody for banks.

About Banking Deregulation

Click to access pidsdps0127.pdf

Will the Asean integration bring entry of Malaysian banks.

2001 is past the expire date for me. he he

the librarian keeps old books.hehe

Here are links to the new banking law

http://www.accralaw.com/publications/after-new-banking-law-deluge

http://www.bworldonline.com/content.php?section=Finance&title=liberalizing-the-banking-sector&id=114681

Both explain what powers are granted to foreign banks under the law passed in July of 2014.

I’d recommend that you elaborate on what the links present so that people know whether or not to click on them. Bandwidth is precious to those of us in the remoter Provinces. Just a short sentence like I provided here would suffice.

Sorry,

I must practice what I told i7sharp.The tanod must not exhibit impunity.

*******

What staggers me is the size of the “great unbanked” population. Only “about three out of ten adult Filipinos possess bank accounts.”

*****

hand to mouth existence err, hand to gadgets, foodies, concerts, consumerism existence may explain it, sir edgar…not many possess even some kind of emergency fund tucked in, in banks or under their mattresses, then they borrow when emergencies arise. five days before the next salary and employees are already asking for cash advances.

and of course the unbank relies on 5-6

http://pinoysuccess101.blogspot.com/2011/03/understanding-lending-or-pautang-in.html

loansharks fund elections.

http://www.rappler.com/newsbreak/16412-loan-sharks-fund-election-campaigns,-lgus

we are screwed.

*******

Oh, the depths we sink into. That’s an eye-opener, Karl.

*****

In certain areas, they are said to augment those loan shark schemes with kidnappings and extortion rackets. There’s a seasonal pattern.

The banks behave in a way that one would almost think they don’t want the business. Two photo IDs (which not everyone will have), maintaining balances of several thousand, interest rates that are somewhere between “awful” and “terrible”… for a lot of Filipinos, the gains of being a part of the “formal” banking sector are too small relative to the costs.

This is one reason we hear of so many investment scams, too.

Customer service improves markedly if you have big money with the bank. Otherwise, it is a cattle call. I quit Land Bank when they installed a waiting system, a row of 15 chairs, four rows deep. You’d get at the end, say row 4. When the customer in chair 1 was served, everyone would stand up, move to the next chair, and sit down. You’d do that about 50 times if it was crowded. Even the US army did not submit its recruits to such indignities, and I learned to hate lines in the army. Especially the one for shots. I’d rather have my money in cash in a can.

You will stand and sit about 50 times, whew… look at the brighter side… it will reduce friction from sitting too long..hahaha…just fan it before taking your seat as it might still be hot from the previous occupant..

I remember a story in high school – a teacher asked the student who stood up, to explain the topic on hand, he said he did not stand up to answer, and when the teacher asked why he stood up, his answer was “just reducing friction, ma’am”

That’s funny. When my wife was 8 months pregnant, she went to the teller at BDO to get 25K so as not to have to stand in the sun in the line at the ATM. They wouldn’t let her have the money (her money, not theirs) because it was less than the 50K ATM limit. She had to go to the ATM line. I’d withdraw less than 50K regularly, just presenting my white face as credentials to gain the exception. MRP does get some things right.

Haha, true, so true…MRP does…if only…, ok, ok, I’ll stop here..one Jolly Cruz to deal with for a night is enough.

Nowadays, being preggie, a PWD or a senior citizen will automatically allow you to jump a long line…that was cruel thing they did to your wife.

That’s what I screamed at the manager. (Didn’t really scream, but there were exclamation points behind my sentences.)

Well, you have to have money to have an account. It is indeed a cash society.

In Germany and Austria, and in much of Eastern Europe now as well, there is the Raiffeisen Bank. It is a cooperative originally formed to help fund poor farmers…

There are also some cooperative banks originally founded for workers. Wonder if stuff like that exists in the Philippines. Cooperative banks played a major role over here in keeping workers and farmers out of the poverty trap, helped them get good loans for different needs.

https://en.wikipedia.org/wiki/Savings_bank – plus these institutions also play a significant role at the local level in Continental Europe – again the British don’t have them, and there a lot of poor people do not have bank accounts as well:

A savings bank is a financial institution whose primary purpose is accepting savings deposits and paying interest on those deposits.

They originated in Europe during the 18th century with the aim of providing access to savings products to all levels in the population. Often associated with social good these early banks were often designed to encourage low income people to save money and have access to banking services. They were set up by governments or by or socially committed groups or organisations such as with credit unions. The structure and legislation took many different forms in different countries over the 20th century.

OK; I saw that England and USA have them too… but in there it seems large commercial banks play a far bigger role… savings banks in Germany as well as cooperative banks play a major role in funding SMEs at the local level, giving people good loans for housing etc.

There are cooperative banks and other grass roots lenders. I hope to get into a discussion of that in a later installment. They don’t keep many out of poverty, I think, but bridge between planting and harvest.

Exactly, edgar!

That’s what I was trying to say here, re Philippine sex-workers and their un-tapped economic potential (but which in that list above will be best to offer services to these girls?):

https://joeam.com/2015/10/25/money-matters/#comment-143296

http://www.rappler.com/move-ph/33-editors-pick-moveph/15103-should-the-ph-legalize-prostitution

maybe a congressman filed a bill during the time the article was published which was 2012

Joe the tables do not have enough info to at least compute one simple Leverage Ratio. That is a basic risk ratio which the Bangko Sentral has set as under 5%, in accordance with Basel 2. That means banks cannot leverage 20 times their capital. What’s missing are the info on off-balance accounts.

On both assets and liabilities I can’t see trade-related accounts which I can only assume have been grouped under ‘other’s. If that’s the case, it seems Philippines trade financing business is very low key, because it’s international trade is very small.

On the assets side there is a low 138bb interbank deposit, but none on the liabilities side. I can only conclude inter-bank money market transactions are very low. Which means banking industry is basically domestic deposit-loan types.

On the assets side, the securities figure is a big component, too bad you have no breakdowns so we don’t know if it’s only govt securities or other more interesting stuff. The more we can peep into this, the more we can know the sophistication of the banking industry here.

On the exposure to real estate, whilst significant in terms of bank asset distribution, doe’nt tell us much of that industry. Missing is the level of fundings from savings agencies and developers.

At the moment, bank reserve ratio is 20%. This is relatively high in comparison to many other countries. This means the banks’ cost of funds are very high because for every 100 pesos deposited the banks can only lend out 80. Bangko Sentral seems to use the reserve ratio more for liquidity control purposes rather the the money market operation way of buying/selling treasury bonds. This means the reserve ratio is adjusted more frequently than the banks would have liked because it bothers their cost of funds computation. Countries that use money market operation for liquidity control purposes very seldom need to adjust the reserve ratio.

Para 1 — I mean off-balance sheet accounts

Is it just me thats got a broken calculator or is there another reason why I can’t seem to add up the list of assets to equal total assets? Maybe the table needs a CPA…correcting plug asset? hehehe

It’s a long story, as to why my old computer broke and I have no excel on my new computer and the internet connection is really really stinko, and that, my friends, is the reason for the arithmetic. Globe did it. I had to transcribe the numbers manually and . . . well, enough of that . . .

Of, if I used LCpl_X’s reasoning, I just wanted to test who was reading this stuff. Y’all are doing great.

This is a pretty interesting topic Joem. I was a unibanker at Bank of the Philippine Islands for more than 21 years and I took pride in what I learned from it. I enjoyed the Trust functions of the bank which is separate from the bank proper. Used to handle securities (stocks) and money market too.

Ah, hi, arlene, glad you get something from it. Your mentioning trust reminds me of when I had to coordinate the transfer of US$3 billion in bearer bonds from the old trust security vault to the new one about 10 miles away. We had to inventory them as they left, pack them, seal them, get them to the armored trucks (four large ones) and convoy down the roads and freeway to the new location, where they would be unpacked and inventoried again. Sure enough, one of the trucks got a flat tire and our convoy, protected by an army of armed guards and police stalled at the side of the freeway for a couple of hours until a new truck arrived and the bonds could be transferred.

Earlier in the morning, the Trust boss and three other portly gentlemen got stuck in the wee small service elevator of the old bank building we were leaving. It took 20 minutes to get them out. The exit from the vault to the street to the armored trucks was through the bank branch proper, giving apoplexy to a lot of the elderly customers that frequented the place. They found the shotguns of all the guards disturbing.

And people think banking is boring . . . . 🙂

Oh, that was unfortunate, part of the risk of transferring big amounts from one branch to another. I like the trust business of the Bank, you’re right, it is not boring. You learn so much when to buy when the market is at its bearish mode and when to rake in some money when it is at its bullish. One must learn to spot the right timing since even a little bad news affects the market. Learning how treasury bills work (they’re the safest investment by the way) and investing in the stock market is fun, just choose the blue chips when buying though. Investing in securities are okay, much more when you make it long term. Just imagine, you are a part-owner of a business entity 🙂

Joe in our part of the world we hardly see bearer bonds, even in Singapore which is a financial centre.

Yeay, so sorry, I misspelled your name….blame it on my arthritic fingers.

Joe, this is not a substantive comment. It is just to have some of the numbers in order.

1. On the last two tables: the number 9334 Billion for total assets jibes with total liability, including capital accounts (7171+1018+1146 = 9335). Check.

2. Second to last table on univ bank assets, the total for other loans of 574 is 822 unless some of the sub-numbers above the line is incorrect.

3. Still on second to last table: if one adds 3925, 291, 822, 362 one gets 5400. This does not reconcile with 4790 at top of table?

4. If we take 9334 as a solid number (note 1 above) and the 5400 number as correct instead of 4790, then replacing 2186 with 3934 reconcile the numbers — of course there are a lot of permutations. In short, is it possible?

Total Assets 9334

Financial assets 3934 instead of 2186?

Loans 5400 instead of 4790?

Frankly I am not bothered by the items above, after all we are looking at the order of magnitude of the numbers — the big ticket items, so to speak. (I may have other non-arithmetical comments later.)

NHerrera you’re one good number cruncher who bothers to do the maths. Now Joe can’t sleep until he figures it out.

I think the error is in the Reverse Repos 248. These are securities purchased with agreements to sell them back at a certain time. Wonder why it’s in this line.

Yes, absent the 248 item, the total is 574. (I did a mental rounding and adding of some numbers and noticed the numbers do not “compute” so I whipped the good old calculator. I certainly didn’t mean to make Joe lose more than a few minutes time. 🙂

Because reverse repos are essentially and legally bank loans collaterized by the security. The bank has no price risk on the security because the borrower buys back the security at a price set to assure no gain or loss to the bank except for the interest on the loan. When I worked on Wall Street thats usually how my investment bank financed its securities portfolios so in this case those are probably loans to securities broker dealers or other banks.

Thanks. Let me look at that. I think the lessons remain the same though, correct?

Yes, my focus — myself, not at all savvy on bank matters — is on the dominance (80% of assets) of the 21 Universal Banks. For that matter, might as well include the Commercial Banks and Thrift Banks. If they remain in good shape and true to country’s development, doing the necessary due diligence in their loans, while making money for themselves, the country will be in good shape too, as far as a Banking System is concerned.

For the boys ..Feauturing Megan Young

Daang, my spelling really sucks.

karl, your taste is impeccable.

Thanks.

Just for the record, there is a bit of art to the number crunchers’ presentation of figures. Joe’s presentation here sucks, but we know he is not numbers guy haha.

The goal for me is to lay out the banking system in simple way that allows lay people to understand how it all fits together. If the presentation “sucks”, it means I did not get across the points I intended to make, and I’m sorry for that.

My goal is not to show people how to be accountants. I would have no idea.

Sorry Joe, my impropriety… the data is good. I mean to say only about subtleties of underlining and double lining and boxing of numbers. It’s a geeky thing. No big deal.

Ah, yes, our accountants were always instructing me on those things and I somehow never thought they were all that important, compared to the data, but I do remember the double underlining and $ only on the top and summation lines. In this one, I am aiming to speak to people who don’t really live with numbers, and so want to simplify. I appreciate the explanation.

PARETO PRINCIPLE APPLY TO THE TOP 3 BANK CATEGORIES

To a person like me with no banking-like or related experience, I appreciate the numbers of the first table — which shows that the rural banks which help the smaller businesses in the rural areas; and the pawnshops which the poor frequently avail of — are so many in numbers, but count only for some 3% of the total banking system assets, 97% being taken by the Universal Banks, Commercial Banks, and Thrift Banks. Focusing ONLY on these three which will likely be the source of a Banking System and hence country trouble if it comes to that, we have:

Category ———— Number – Num % – Assets — Ass %

Universal Banks — 21 ——- 19.8 —– 9256 —- 83.6

Comm Banks —— 15 ——- 14.2 —– 891——- 8.1

Thrift Banks ——- 70 ——- 66.0 —– 920 —— 8.3

Total —————- 106 —— 100 —— 11067 — 100

And lo and behold our friend, “the 20-80 Pareto Principle” holds — 19.8% of the numbers of the three bank categories account for 83.6% of the assets.

My sense of this, just like in manufacturing sector and other activities, where Pareto’s 20-80 Principle holds, is that we really have to be careful on how these big fellows go about their businesses — especially the Universal Banks. I believe, without the data to back me up or doing research (blind faith?) that the BSP is on the ball on this. But the knowledgeable of us should take a look over their shoulders especially on the RE bubble that Mary Grace mentioned about @chempo’s previous postings, among others. Good for the Philippines — and for the knowledgeable — that we have previous countries’ experience, among others, to refer to and learn from.

I am glad the Philippine Banking System is being focused on in the Blog.

I hope there will be more blogs on this, Joe— that this will be a rather lengthy series. In writing the Islamic Renaissance article, I was left with more questions than answers… specifically stuff you’ve covered here (and also Micha’s article). Looking forward to chempo’s article as well. Much of it is still going over my head, but as G.I. Joe said, “Knowing is half the battle!”

I think the particulars of banking cause people’s eyes to glaze over, so I want to step through the basics to draw off some simple understandings that lead to a digging deeper into what matters. I’m doing this for myself and just publishing the trek for those who gain from it. For example, I find it amazing how many institutions there are at grass roots, and how few actually hold the big money. So the grass roots organizations really don’t pose economic risk. Whether they are efficient or not, and whether they are healing social ills or not, is another matter. The economic risk (and strength at financing the Philippines) resides mainly among 21 institutions.

You’re the banker here Joe, so I defer to your wisdom on the subject. I would, however, like to share these following videos and hope you could enlighten us if it make sense. Although the narrator here describes the banking system in the UK, I am assuming that most of the basics of banking is the same in the Philippines.

Thanks.

Micha, Joe is a marketing expert and I’m sure he understands banking pretty well, but he’s not into the nuts and bolts.

If I may try to elaborate on the first video:

(1) I think you picked the wrong video to explain money creation. There are some small errors and un-necessary complications thrown in.

(2) UK is not a good choice to explain money creation by bank credit expansion because they don’t have bank reserve requirements.

(3) What is bank reserve and its purpose:

a). When you deposit cash in your BDO a/c, the bank cannot lend all the deposit money out because there won’t be any money if you go back to withdraw. BDO has to retain, or reserve, some money back. It reserves a certain sum from all customers’ deposits. So now they have a big pool of reserve money. If you decide to make full withdrawal, they use the pool money. But if all BDO’s customers try to withdraw at the same time, it won’t have enough immediate money. That will cause panic and a bank run. The bank is financially strong, it just don’t have liquidity. So Bangko Sentral says all ye banks, put your reserve money with me. So now SB has a very very big pool of reserve money from all banks in Phils. If there is a run on BDO, central bank steps in to lend immediate cash from their very very big pool. Confidence will return and customers will stop withdrawing money.This is the original role of central banks — lender of last resort. It is to prevent bank failures from a bank run.

Note (i) that lender of last resort role is not to prop up insolvent banks, like Banco Filipino.

Note (ii) don’t confuse this reserve pool of each bank with the actual physical cash they hold. Reserve is the money they did not lend out. Physical cash is any inventory level that they estimate they need daily.

b).All banks maintain an operating a/c (just like a current a/c) with central bank. When BDO sets aside the reserve from your deposit, this is sent to BS. It will credit BDO’s a/c and debit Currency a/c. These banks’ a/c at BS are know as banks reserve a/cs. The total represents that very very large pool of money in (a).

c) What does this reserve tell you. It gives some reflection on the strength of the financial market. The higher the level, the more insurance there is. This level has 2 effects :

(i) cost of funds to banks — if they reserve too much, means they can only lend out less and earn less.

(ii) money supply — if the level is high, means less is lent out and credit expansion (see below) is less.

d) BS reserve requirement is 20%, Bank of England is ‘0’. BS use this reserve ratio not only for the lender of last resort purpose, but to control money supply.

(4) Bank credit expansion — when you deposit 100 pesos at BDO, they set 20 aside as reserve and lend out 80 to a baker. Mr Baker takes the 80 to buy flour at SM who deposits the 80 at Citibank. Citi sets aside 16 and lends out 64. This process is repeated again and again. With reserve ratio of 20%, your 100 deposit can create 500 pesos through banking credits. UK with no reserve ratio means credit expansion is infinity.

(5) Banking settlement : The video does not show this clearly.

Every day money moves from one person to another and one bank to another. Money moves by actual cash deposits/withdrawals, cheque payments, ATM, bank transfers etc. All these are channeled through clearing houses, which in our digital age, we are using all sorts of technologies. Basically, they are clearing houses — where all transactions get sorted out and on a net net basis they know BDO need to pay Citi xx pesos, Allied Bk pay BDO – xx pesos, etc. These net net payment status is sent to SB which then debits or credits each bank individually into their respect operating a/c mentioned in (3b).

At the close of business, each bank will check their balance of their operating a/c at SB and make sure that the balance there is at least 20% of their total deposits liabilities. This is a daily compliance requirement. If they are short, they borrow at the money market to top up. Banks will not keep unnecessarily large balances in their reserve a/c because they are non-earning assets.

Note: All money transactions end up at the SB books where bank a/cs are debited or credited accordingly.

There are many such clearing house mechanisms in Philippines. Check here for details http://www.bsp.gov.ph/financial/payments/philpass.pdf

chempo,

What is the reserve ratio requirement in the Philippines?

Oops, never mind. I didn’t get to the bottom part of your post before asking that. Still, at 20%, does that mean Philippine banks could only lend out that much from deposits?

banks can only lend out 80%, multiplier effect is 5X

20%

Here is the video explanation for what’s wrong with money multiplier (bank credit expansion, in your terms).

Micha, for the 2nd video, I would suggest you ignore it totally. It just adds unnecessary confusion.

Just understand this.

Bangko Sentral has a reserve requirement as explained in my comment above, and how that ratio affects money supply.

Apart from this reserve ratio, banks all over the world operate under a lot of other compliance requirements. They need all sorts of daily, weekly, monthly, quarterly and annual central bank reports. Central bank sets all sorts of constraints and they need these reports to monitor compliance and various risk exposures.

One of the risks that central bank will monitor is bank liquidity. The reserve ratio is one of them. Others will be like they will set up certain asset level requirements — eg securities, term loans less than 1 year, repos, etc etc. There can be many configurations, bottom line is they want to make sure certain % of assets under what they term as liquid assets. They may call this liquidity ratio1, and next liquidity ratio level 2 etc.. I don’t know how BS does it, its just stratification of asset categories based on liquidity.

That’s all to it. Forget that video.

The 20% reserve ratio requirement in the Philippines expands the base money to 5 times, right?

No. It expands bank deposits 5X. It’s mathematical expansion, does not mean you take all bank deposits in the country and multiply 5 times. It means if you can trace one initial deposit through it’s life cycle it creates 5 times the money. Of course it’s a chicken an egg situation again. How would you know if the money you deposited is the 3rd or 4th cycle etc.. It’s just a mathematical formulation, so quantitatively, it shows how money supply can expand. There are lots of other issues, like velocity of money etc. There are modelling tools…that part is Rhiro’s domain. Me I only understand the debits and credits.

What it means, theoretically at least, is that banks could only max out their lending at 80% of what they have in deposits. Take for example your bank, BDO, would it be accurate to say that at any given time, its lending ability is restricted by how much deposit money it has?

Theoretically yes, but in reality no.

The reason is this. Banks got all sorts of fundings. Deposits is one one of them. Out of this deposit funds they can max out 5x. But they have other funds…like paid up capital, prior years undistributed profits, general reserves, long term debt borrowings (debentures etc), interbank borrowings. So their loan assets will be more than 5x their total customer deposits at any time.

There you go. The whole pretense that deposits fund loans is just that – a pretense. In reality, banks approve loans not necessarily by how much deposits it’s got but by how much confidence it has that the borrower could pay back those loans. Afterall, approving loans is as simple a process as affixing the bank manager’s signature to the loan agreement and crediting the borrower’s bank account with electronic bank numbers.

With all do respect, you are striving for a concept that is irrelevant to the bankers themselves. They have lending departments to make loans and branches to take deposits and they grow them both and make profits. Some esoteric argument that the loans don’t fund the deposits would cause them to leave the room, heads shaking, and head for the nearest bar. I hope you can monetize the idea, though. Write a book or two. I’m all for you.

You are dead wrong Micha, deposits represent an important source of funds for banks. Whilst signing the Loan Agreement is a simple thing to do there are many things going on in a bank before a loan is granted. As Joe pointed out, there is an Assets/Liability committee and some others. Money is a limited commodity, so within a bank, which is profit driven, there are lots of components chasing the limited resource. Just like the govt which does annual budgets, banks do too. Whilst bank budgetting probably may not be as tough as a govt’s, it nevertheless is pretty tough thing as compared to most other corporations. Trust me, a lot of behind the scenes thinking went on before a loan is easily granted.

If deposits are just a pretense why go the length and trouble and expense of attracting depositors and having branches 500 metres from each other. The CEO that trivialises deposit money won’t survive long in the industry.

Well I guess we’ll just have to part ways on this one given that there’s alternative explanation that I, at least, find more coherent.

Micha,

Let me also add this to your stack of videos, re Islamic banking (pay close attention to “external, independent panel of qualified shariah [Islamic economy & finance] scholars”)—- I was wondering if morality/ethics is addressed similarly in conventional banking, ie. AT&T invests in the porn industry, Time Warner invests in online gambling, etc.

is it really possible to account for investments in “prohibited industries”?

@Lance Cpl

I like the concept of interest free loans. The Positive Money movement in the UK also advocates, if I’m not mistaken, the same scheme.

If you’ve watched the video I linked above, it bares out the mechanism that belies the all too common notion that bank deposits fund bank loans.

I’m not sure if our resident bankers, chempo and Joe, will agree.

Banks have “Asset/Liability Management Committees” that take on the process of matching assets and liabilities for term and rate. Deposits are the primary source of funds for lending for non-investment (community or commercial) banks, and if they do not fund loans, I’d like to know what the banks have been doing with my money all these years. Of course, they convert it to electricity, but that’s what the loan is, so who cares. Indeed, I am paid in electricity and leave the paper and coin withdrawals to my wife, who is most adept at getting rid of the stuff. Maybe instead of being mysterious, tell us, what DO banks do with our deposits if they don’t lend it out. I don’t have enough bandwidth to pull up all these videos and reports y’all are pushing out. I’d like a simple explanation, in words.

…what DO banks do with our deposits if they don’t lend it out?

Your deposits sit idle in the bank’s electronic vault earning certain interests until such time you decide to draw it all out.

But if we follow the 20% reserve ratio requirement in the country, supposedly 80% of your deposited money gets lent to somebody else. Whereupon if you decide to actually withdraw all of your money because you want to, I don’t know, maybe buy a new house, you’d expect your bank to say, “we’re very sorry Joe, but you could only withdraw 20% of your money because the rest we lent out to Mr. Xavier and Mr. Yulo.”

Is that how the narrative goes?

This is highly reminiscent of It’s A Wonderful Life. 🙂

To quibble, to split hairs . . . It’s a separate reality I care not to enter. Deposits go into a pool of funds that gets apportioned out to fund loans and other assets. It is not rocket science. Nor is it voodoo magic sold around the intellectual circuit like snake oil.

Ok, so I guess that means it’s perfectly alright for you Joe if your bank tells you they couldn’t give your full deposits back just yet even if you badly needed it because they pooled it to grant loans to somebody else.

It would be interesting to see real figures from, say, Metrobank or BPI how much loans outstanding and how much deposits they have at any given time.

Banks manage their cash supply based on withdrawal trends, plus excess, and stock up at times of peak demand. A demand deposit is just that, a contract that says I can get my money in cash whenever I want it. What you are speculating does not happen because deposits are not matched to a loan, they go into a pool that funds the loan, a portion of which is dedicated to cash on hand in branches. Your theoretical suppositions just aren’t the real world.

Indeed, if you actually read the blog, you would see that looking at individual banks is one of the future steps because I am just as curious as you are.

Banks have correspondent relationships with other banks so the pooling actually goes inter-bank if need arises. I once hiked two blocks down the mainstreet of Westwood, CA near UCLA (with a dual-custody sidekick) to withdraw a large pile of cash from Bank of America to cover an unexpected large withdrawal at our branch. We used grocery bags to haul the stuff, and every college kid we passed somehow looked sinister. In the real world, banks honor their contracts, customer service (in the US) is king, and only a major financial collapse would mandate the failure to abide by a contract, and that would be done under regulatory auspices.

No dis-respect meant, but you guys obviously have never drawn substantial sums of money from banks before. I used to be a manpower officer in my Army days so I used to go collect the camp’s payroll. Those days all got paid in cold cash so the withdrawal sum was substantial. We had armed escorts. Now of course if I walked into the bank un-announced, they probably wont have enough cash for me. So if you have an impending huge sum for withdrawal, you need to co-ordinate with them and the particular branch will make sure they withdraw enough from the central bank to stock up their cash vault so that they can service you.

I almost started to explain that large cash withdrawals require advance notification, but it was not relevant to the point. The issue is, do deposits fund loans, and they do, by a bank putting them into a pool of funds and applying them for this and that, cash in branches being one of the applications, and loans being another. A person CAN get his money on demand, with an asterisk for large withdrawals. When I go into a bank to withdraw, I am not forcing the bank to call some poor borrowers loan for repayment.

Picture this for a moment. Joe is at Banko sa TabiTabi branch in Biliran being told by the manager who is telling everyone else to come back tomorrow to make a withdrawal from their demand deposit accounts. Joe and everyone at the counter reach for their cellphones and my question is. How’s long do you think before all the bank’s Biliran depositors are clamoring at the branch location demanding their money? That’s why itwas referred to as bank run but now they drive up in their cars 🙂

Right. 🙂

Banks have other funds…like paid up capital, prior years undistributed profits, general reserves, long term debt borrowings (debentures etc), interbank borrowings. They can also play with derivatives of all sorts – end result they get pools of funds to us. Customer deposits is just a part of their funds.

A large part for Philippine universal banks.

Some Muslims are humans too (others are Gods and can kill at will – if later the sex of a slave or a heavenly virgin is for free)

Journalist John Foster quotes an investment banker based in Dubai:

We create the same type of products that we do for the conventional markets. We then phone up a Sharia scholar for a Fatwa … If he doesn’t give it to us, we phone up another scholar, offer him a sum of money for his services and ask him for a Fatwa. We do this until we get Sharia compliance. Then we are free to distribute the product as Islamic. “Top scholars” often earn “six-figure sums” for each fatwa on a financial product. (Wiki)

*******

🙂 😦

*****

If he doesn’t give it to us, we phone up another scholar, offer him a sum of money for his services and ask him for a Fatwa. We do this until we get Sharia compliance. Then we are free to distribute the product as Islamic. “Top scholars” often earn “six-figure sums” for each fatwa on a financial product. (Wiki)

That’s pretty apt description of https://en.wikipedia.org/wiki/Ijtihad#Sunni , josephivo.

Ijtihad has the same root as jihad, that’s j-h-d ( جهد ), basically means to struggle/strive to square the Qur’an with what the Prophet did, w/ what his Companions saw or heard him do (and what those Companions told the next gen), to that of human reason.

To me it’s not only arbitrary, but since the Sunni Muslims don’t have top-down type clergy (like the Shi’as), seems like utter chaos. Same goes for other types of fatwas as well not just in finance.

I think, karl, in particular will get a kick out of this fatwa, https://en.wikipedia.org/wiki/Rada_(fiqh)#Fatwa_controversy_in_Egypt

As shoddy as it seems, there is a market for Islamic finance/economics and a need for “scholars”, so the question is can all this be translated to opportunity for the Philippines?

Now there is a whole new set of balance sheets for me to wreak havoc on, to see how they make money without charging interest, and how they draw the lines that lending to finance a pig farm would be a no-no but funding a terrorist organization is hunky dory. I hope you continue to develop your interest in exploring these matters so you can keep me out of the picture. 🙂

Let me see how it goes, I think I can handle the Islamic economy/finance, shariah “scholars” side of this story, but you (or chempo, or Micha, or caliphman, or other interested regulars, with an Econ or accounting background… ) will have to do all the bean counting.

Hopefully, Ireneo, can touch base with his peeps in Berlin— so we can pawn this assignment to him. ;-P It is an Anthro subject after all.

Micha — my comments on money gets destroyed when debt is paid

Money only gets destroyed when you burn your peso notes or you drop your wallet into the Philippines Seas never to be found again. That money gets out of the money supply. They are gone from our economy.

Other than that, any money that has been created into existence remains in the system always. Let’s take a look at a simple example. You got a 10,000 pesos loan from BDO. For your good work at the Society, Joe rewards you by giving you a check for 10,000 pesos drawn on Citibank. You deposit the Citi check into your overdraft a/c at BDO. That extinguishes your debt. But did it change the money supply? NO. Because this transaction will end up at Bangko Sentral’s books where Citi a/c will be debited and BDO a/c credited. BS merely moves funds from one bank a/c to another. Money supply remains the same. Nothing has changed.

Throw that video away.

chempo,

The point is that, when the loan gets paid, that money leaves the economy, sits idle in the bank’s accounting balance sheet unless and until it gets re-injected into the economy in the form of another loan.

No Micha, nothing changes. Funds moved from one bank to another, that’s all. It’s still in the economy. Citi banks depo liability has gone down because you banked in Joe’s check. But BDO’s deposit liability goes up because you extinguished your overdraft a/c. Net net in the economy, still the same.

Money that sits idle in the bank’s electronic vault is not in the hands of consumers who wanted to buy stuff (goods and services). The velocity of that money is zero. It is not doing anything to stimulate economic activity.

Micha, look it this way.

Before Joe write that check for you, his a/c in Citi has a credit balance of 10,000. That balance gets into the M2 computation. You have to agree with this , right?

Then Joe’s check drawn on Citi reduces his deposit a/c, so the M2 goes down, right?

Previously you a/c at BDO was negative 10,000 overdraft. Nothing to do with M2.

When you deposit Joe’s check into your BDO, your a/c is now ‘0″, from negative 10,000 to ‘)’ means a positive change of +10,000. (means overall for BDO their customers’ deposit a/cs went up bu 10,000 because of Joe’s check that you deposited). So this 10,000 now goes into the M2.

Net net equals to no change in money supply.Means when debts get extinguished, there is no change in money supply. Funds just move from one person to another, means from one bank a/c to another in central bank’s books.

Fundamentally agree with the transactional flow of course. And the flow leads the money to where? The bank’s reserves, I would assume, right? That gives the bank higher leverage to grant loans. But until such time that those money actually gets lent to somebody else, that money is idle, no velocity. It has potential for movement but nonetheless currently idle.

Micha, every money that is deposited remains idle until re-lend. The issue we are talking about is whether it’s vanished from the M2 money supply when a debt is extinguished. And it does’nt.

Again, agree on the fundamentals. The video refers to money that’s removed from the economy, not the electronic money on bank reserves.

Like I said Micha, throw away that video.

Hahaha, no way Jose. I learned more insight from it than a university-belt banking degree.

Banking is so important in our economic life to be left to the bankers alone.

Chempo Is the sentence below correct?

Money in circulation is part of the overall money supply,those in piggy banks is still part of overall money supply.

karl,

The difference is that you could always take out a hammer and smash your piggy bank if you wanted to buy some ice cream. You can’t do that with idle money kept in electronic bank vaults.

good point.

Money in circulation are all those notes and coins issued by central bank + all banks deposits (electronic money) LESS bank reserves.

Bank reserves are all those electronic money that banks have in their operating a/cs with the central bank. This should correspondent to 20% of banks total deposit liabilities. (Of course not exactly, there is always a + or -). This money being reserves, are not in circulation.

Whether you deposit checks, or crispy peso notes, or you bring the little piggies stuffed with centavos, does’nt matter. You end up with electronic balances in your a/cs. That’s the balance that gets into the M2 money supply computation.

NOTE: deposits exclude money market deposits (bank to bank depos) this is in the M3 computation, not commonly used.

If you take money in circulation + bank reserves, you get what is known as Base Money or sometimes they call it High Powered Money

10-4

“Money in circulation is part of the overall money supply,those in piggy banks is still part of overall money supply ”

Karl, maybe I did’nt answer your question in simple terms. If it’s still under your pillow, the answer is YES.

Of course Micha is correct. But note that when it comes to money supply, things get bitchy here. Mostly we use M2 in which case YES, notes and coins in bank vaults are not part of money in circulation.

copy.

Lance, a good resource,

http://religiousstudies.stanford.edu/islamic-studies/

oops that is the college course, but for the different militant groups

here is an example our very own Milf

https://web.stanford.edu/group/mappingmilitants/cgi-bin/groups/view/309

RESOURCES

Around the 1990s, the MILF received funding from Al Qaeda and from Mohammad Jamal Khalifa, Osama bin Laden’s brother-in-law, who founded various charities that funneled money to the MILF and similar groups. However, the MILF primarily funds itself through extortion and also reportedly profits from marijuana trafficking, although the organization denies engaging in illegal financing activities. [55]

Further, the MILF collects alms—called “zakat”—from Muslims, sometimes in the form of taxes within the zones that it controls. [56] The MILF also reportedly receives money from various Islamic states, such as Saudi Arabia and Iran, and individuals in those states. Other funding sources include money diverted from foreign Islamic nongovernmental organizations and remittances from Moro members of the United Overseas Bangsamoro. [57]

The MILF is reportedly the most well-armed of the Philippine militant groups. The MILF allegedly stockpiled explosives and landmines during its 2000 war against the government. The Armed Forces of the Philippines estimated in 2006 that the MILF controlled 8,170 firearms, most of which were rifles and grenade launchers. Some analysts give higher estimates of the MILF’s weapons cache. [58] The MILF’s weapons sources include domestic and foreign black markets, captured stockpiles, and their own weapons production. [59]

That’s an excellent resource. Although you have pulled some excerpts that reflect how well armed the group is, the paper does also point that the MILF is engaged in the peace process, and is a force of moderation compared to the more violent groups such as MNLF and BIFF.

A paper on Islamic Banking

Click to access islamic-banking-guide.pdf

year 2000 is expired so here is a paper published on 2013

Click to access wp13184.pdf

Thanks for all this, by the way, karl…. still reading thru ’em.

The latest country report on financial stability asessment by the IMF of the Philippines

Click to access cr1090.pdf

Thanks. Very helpful for future blogs.

Joe,

Fingers crossed for those five nominations in the Bloggys Awards. I’d say it has a pretty good chance in four categories. 🙂

May this be the year we can say we made a difference!

May I ask Will to bring someone to take pictures or a short video clip. maybe he can post it as an off topic comment later.

win or lose,we already made a difference.

Still photos, yes, Karl. Video on iPhone, too.

yehey! if you are not blogging about it,just put it in a comment box in the topic for the day.thanks.

We definitely made a difference this year, award or not. I know that for a fact. We’ll see what the judges think. Raissa is also in our category, so there is definitely competition.

These seven groups dominate the economy

groups dominate economy

Asiasec’s report identifies seven conglomerates that dominate the Philippine economy, without labelling them as oligarchs. These are: San Miguel Corp. (SMC), Ayala Corp., First Pacific, SM Investments Corp., JG Summit, DM Consunji and Aboitiz.

Asiasec says that, among the conglomerates, SMC has a very tight grip – its control and ownership remain substantial in its key business units – compared with the other groups that have neither a super majority interest nor a consolidating stake of 51% in their key businesses.

SMC has 100% interest in its power generation business, 90% in Petron (fuel and oil), 100% in telecom, 99% in food, 78% in Ginebra, 99% in property (San Miguel Properties Inc.), 70% in Bank of Commerce, 100% in mining (coal) and 100% in airport (Caticlan).

SMC enjoys majority interest in San Miguel Brewery (51%), Metro Rail Transit 7 (51%) and toll roads (51%).

In addition, SMC has a significant minority in other businesses: 37% in the Manila Electric Co., 40% in Liberty Telecom and 35% in Manila North Harbor.

Ayala Corp. has 68% interest in Integrated Micro-electronics Inc., 54% in Ayala Land Inc., 31% in Globe Telecom, 34% in Bank of the Philippine Islands and 43% in Manila Water Co.

Asiasec notes that Ayala Corp’s ownership in key businesses it controls such as telecom and banking has not even reached a majority (51%) ownership, in contrast with SMC’s controlling and super majority position in most of its businesses.

‘The power generation ambition of Ayala Corp., which was welcomed by the market, is in contrast a very small wind-farm (less than 50 MW) vis-a-vis San Miguel’s diverse power portfolio (3,145 MW),’ Asiasec says.

Hong Kong-based First Pacific, represented by PLDT Chairman Manuel V. Pangilinan, has a controlling interest (100%) in TV5, majority interest in Metro Pacific Investments Corp. (55%) and controlling but not majority interest in Philippine Long Distance Telephone Co. (27%), Philex Mining Corp. (46%) and Manila Electric Co. (41%).

Henry Sy’s SM Investments Corp. (SMIC) has controlling interest in its department store business (90%) and supermarket (100%), majority interest in SM Prime Holdings (51%), controlling but not majority interest in Banco de Oro (41%) and SM Development Corp. (44%), and significant minority interest in China Bank (20%), Highlands Prime (31%) and Belle Corp. (35%).

‘For the SM group, it is worth highlighting that their retail assets (department store and supermarket) are all consolidated under SMIC and remain super majority,’ Asiasec says. ‘They have a majority controlling interest in SM Prime, albeit the ownership has been opened to the public, and controlling interest in both SMDC and BDO.’

John Gokongwei’s JG Summit has controlling interest in petrochem (80%), majority interest in Universal Robina Corp. (60%), Robinsons Land Corp. (60%), Digital Telecoms (50%) and Cebu Air (65%), and a significant minority in UIC (32%).

The Aboitiz group controls Pilmico (100%) and Aboitiz Power (76%) and has controlling but not majority stake in Accuria, its transportation business, at 49.5%.

DMCI has a 100% stake in DMCI Homes, 56% in Semirara Mining Corp. and 33% in Maynilad Water Services Inc.

http://www.twn.my/title2/resurgence/2011/251-252/econ1.htm

That’s a wonderful profile. Thanks, Karl. Dated 2011. There are two ways of looking at it. That the Philippines is “at the mercy of” in a negative way, or “is blessed to have the financial power of” for development of the Philippines. My view has shifted to the latter, to the positive. Regulations have to be deployed to makes sure the Nation’s interest are not set aside in favor of the Big Boys. Bam Aquino’s “Competition Act” is a big step forward, if implementation is assertive.

You are welcome Joe.

The implenenters must craft an IRR that has no loopholes and is doable.

Both Germany and Japan started their progress with certain rich men or families bankrolling it.. Thyssen and Krupp in Germany, Mitsubishi and Matsu shita in Japan…

in a later stage of development, large banks became the new oligarchs… Deutsche Bank, Dresdner Bank, Commerzbank are major stockholders in “Germany Inc.” industrial firms… large Japanese banks like Sumitomo I have read play a similar role in Japan, with their representatives sitting on the boards of major corporations… a few billionare families remain in Germany like the Quandts who own large parts of BMW… one of the Sauds is now a major stockholder in Daimler-Benz (Mercedes).. the rest is all minority stockholders.

These are the oligarchs that are benefiting the most from the Philippine’s economic growth and when the country is reported as getting richer, it really refers to them and their lesser ilk. In Micha’s Money Matter’s piece, I seem to recall someone asking what the study of macroeconomics is about and why bother. The former requires a very extensive, descriptive, and somewhat historical, possibly quite boring response but the latter? Quite simply to try and understand and get a handle on the key problems facing market economies: recession/depression/unemployment/ lack of growth…and the one problem that keeps getting worse even here in the United States, the increasing concentration of wealth and power, particularly in oligopolistic market economies such as in the Philippines.

Apologies for digressing even further into the subject of oligarchs and their economic dominance. It is interesting to note that the all the top ones mentioned did not include full or even majority ownership and control of a top tier bank. Their core businesses appear to be strong enough financially to finance expansions internally. The role of their investments in banks seems mostly because the latter are close partners in financing customers of their core businesses rather than as an intermediate move to become a major player in the banking industry.

Very interesting point.

I thought Ayala,Sy and Aboitiz would have more shares in their families banks ,that is not the case. The Gokongweis and Lopez gave up banking to the Sys.

i think Lucio Tan is missing in the mix, maybe I ‘ll just refer to Forbes Top 1000.

Tan’s name is attached to PNB and Allied Bank.

There are a lot of Filipino billionaires Forbes lists thats omitted like the Razon (shipping), Andrew Go (real estate development), Cactiong (jollibee), Ongpin, etc..rtc.

Yes caliphman.

The exchange of Micha and Chempo can be like what is found in this link, it explains what happens when you deposit your money to the bank,the multiplier model thing,banks as the middle man perceptions.

http://positivemoney.org/how-money-works/advanced/the-money-multiplier-and-other-myths-about-banking/

Karl that’s a good ABC of sorts.

The second half where Professor Charles Goodhart mentioned that reserve money is actually an post-fact computation (lend out first, then check reserve levels), he is correct, as was what I commented much earlier above.It’s a chicken and egg situation. However, what banks normally do is that before the close of business day, they have a pretty good idea of their reserve requirements (it’s real-time book-keeping right?) so normally one of the last thing they do is to make sure their operating a/c at the central bank is at the appropriate levels (in Philippines 20% of customer bank deposits). If it’s in excess, they place it out in the money market, if not adequate, they take deposits from the money market. Most times they are out by a bit + or -. Central banks are not so bitchy and penalise banks for daily non-compliance because of the dynamics of the business. So they normally work on a weekly or bi-weekly or monthly average of the reserves, then they fine banks for non-compliance if ever.

Thanks again.

True and it is required also in companies performing quasi banking fuctions. I worked in a financing company before and part of my work was the preparation of the daily financial statements…balance sheet and income statement …to be summarized on a weekly basis for submission to the Central Bank. We were regularly monitored by three government agencies: the Central Bank, the SEC and the BIR….kept busy at all times as they scrutinized each and every records we have…one extremely idealistic BIR examiner was a particular challenge for me, he performed the most detailed audit in the whole world…it took him two months of pouring at my books of accounts, crosschecking them with every deposit slips and check vouchers…am proud to say he did not find any error… Just diasapproved some representation expenses, so that he could assess a small deficiency income tax….same with the CB and SEC examiners. Those were the days when aside from those 3 government agencies, I have to be at the monthly directors’ meetings to verbally report on the results of the operations based on the monthly FS.

I bet Heid Mendoza will also find nothing wrong there.

Joe there is one Islamic bank in Philippines — Al-Amanah Islamic Investment Bank. Is this included under Commercial Bank?

Have to check later. Very weak internet here. APEC effect perhaps. Hard time loading pages.

Thanks, chempo. From their website,

The New Amanah Bank

Powered by the capital infusion of DBP and the BSP approved 5-year rehabilitation plan of the Bank, Al-Amanah Islamic Investment Bank of the Philippines had completed the re-branding strategy that popularizes the new Bank logo with the tag “Amanah Islamic Bank”. From thence, the Bank uses the new logo in its official correspondences and documents.

The Bank offers the following products and services:

Deposit Products-

Islamic

– Current Account under “Wadiah”

– Savings Account under “Wadiah”

– General Investment Account under “Profit Sharing Scheme”

– Pilgrimage Savings Plan (PSP) New!

Conventional

– Current Account

– Savings Account

– Time/Special Savings

Other Services-

– Collection Agreement

– Payroll Service

– Fund Transfer/OFW Remittance

– EC Pay (Bills Payment Facility) New!

Financing Products under the following principles-

– Murabahah

– Al-Bai Bithaman Ajil

– Ijarah

– Al-Qardhasan (Benevolent Loan)

During the rehabilitation period, the Bank is allowed to accept conventional deposits

and offer developmental loans to the private and public sector.

Amanah Islamic Bank offers on-line banking to its clientele covering the nine (9)

Branches in Cagayan de Oro, Cotabato, Davao, Jolo, Iligan, General Santos, Marawi,

Makati and Zamboanga.

With the new and refurbished branches, the Bank is proud to open its doors to all

Muslim and non-Muslim alike to experience a new way of banking, the Islamic Banking.

Amanah Islamic Bank was first established as “Philippine Amanah Bank” by virtue of Presidential Decree No. 264 by then President Ferdinand E. Marcos. The decree required the Bank to invest 75%of its total loanable funds for the purpose of providing, among others, reasonable medium and long-term credit facilities to the people of the Muslim-dominated provinces of Cotabato, South Cotabato, Lanao del Sur, Lanao del Norte, Sulu, Basilan, Zamboanga del Norte, Zamboanga del Sur and Palawan. Thus, the Bank as been transformed into a development bank with an initial capitalization of P50 million.

In 1974, Presidential Decree No. 542 was issued directing the Bank to implement the Islamic

concept of banking, following the “no interest principle” and the partnership principles. This

directive was not fully carried out because conventional banking still dominated the Bank’s

operations.

It was in 1990 that the Bank became a primarily Islamic bank with the signing of Republic Act

No. 6848, otherwise known as the Charter of Al-Amanah Islamic Investment Bank of the

Philippines (AAIIBP). The new charter provided the Bank an authorized capital stock of P1

billion consisting of 10 million common shares. With the mandate to promote and accelerate

the socio-economic development of the Autonomous Region of Muslim Mindanao (ARMM)

through banking, financing and participating in agricultural, commercial and industrial

ventures based on the concept of Islamic banking.

By mid-1990, three (3) of its branches, Cotabato, Marawi and Jolo, have been transformed

into accepting Islamic deposits. The other branches have been transacting both conventional

and Islamic banking products, services and facilities.

From 1990 to 2007, AAIIBP managed its operation with the support of the Bureau of

Treasury.

On November 14, 2007, the DBP Board of Directors approved the acquisition of AAIIBP. DBP

took full control of the Bank’s operations on July 16, 2008. On October 30, 2008, DBP

completed the acquisition of the shareholdings of the National Government, the SSS and the

GSIS in AAIIBP, thereby controlling 99.9% of the Bank.

On October 22, 2009, the Monetary Board approved the Bank’s 5-year Rehabilitation Plan,

which focused on four corporate strategies (4Rs), namely, Recapitalization, Restoration of

Financial Viability, Reorganization and Reforms Institutionalization. Under the

Rehabilitation Plan, AAIIBP is allowed to continuously do both conventional and Islamic

banking.

In November 2009, DBP infused Php1.0 billion capital to Amanah Bank that marked the

partial completion of the recapitalization strategy. http://www.al-amanahbank.com/History.html

……………………………………. Sharia District Courts (SDCs) and Sharia Circuit Courts (SCCs) were created by President Ferdinand E. Marcos in 1977 through Presidential Decree 1083, which is also known as “the Code of Muslim Personal Laws of the Philippines”. Sharia law only applies to civil cases involving all Muslims nationwide in the Philippines, http://www.lawphil.net/statutes/presdecs/pd1977/pd_1083_1977.html

Expenditure side of Economy—

Government Capital Formation + Business Capital Formation + Personal Consumption + Exports – Imports… Obviously the accounting is done in monetary terms….

Who intermediates the domestic and international payment system ?—Private and Public banking Institutions…The International payment system between banks is regulated by the ICC in Basel Switzerland…There is no International Central Bank…That role is in the de facto hands of the IMF/WB effectively controlled by the G-7 economies…